Similar to the last post, this post updates key facts about Japan digital landscape using 2019 data points since the last one was back in 2017.

This post is part of the series about Japan that I have been writing in 2019. You can find other posts here:

8 key facts about Japan Mobile Game Industry (update Mar 2019)

8 key facts about Japan Subscription Video on Demand (SVOD) landscape

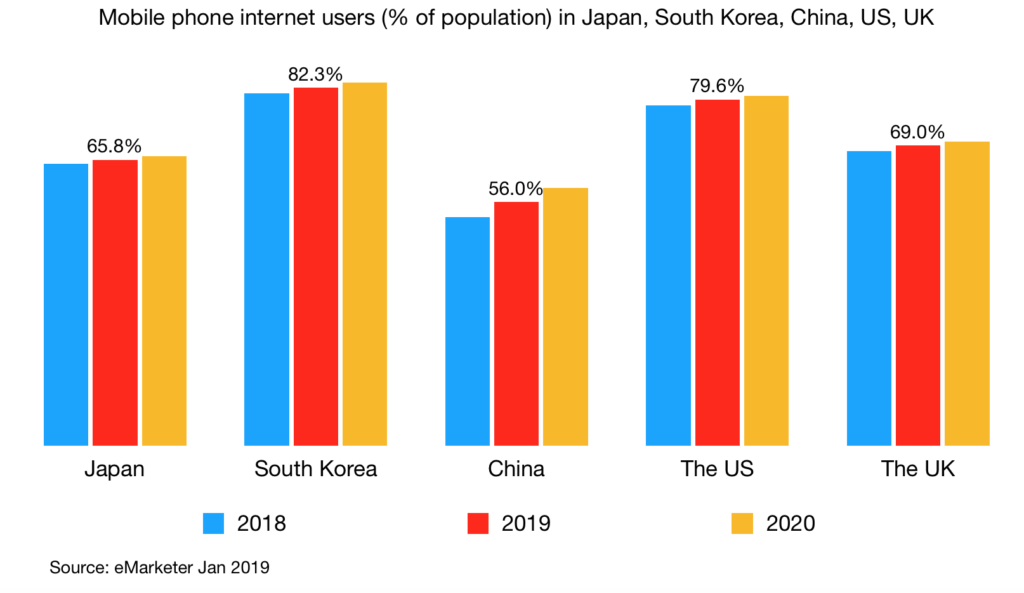

1. While 2/3 of the Japanese population are mobile internet users, they still lags behind South Korea, the US, the UK

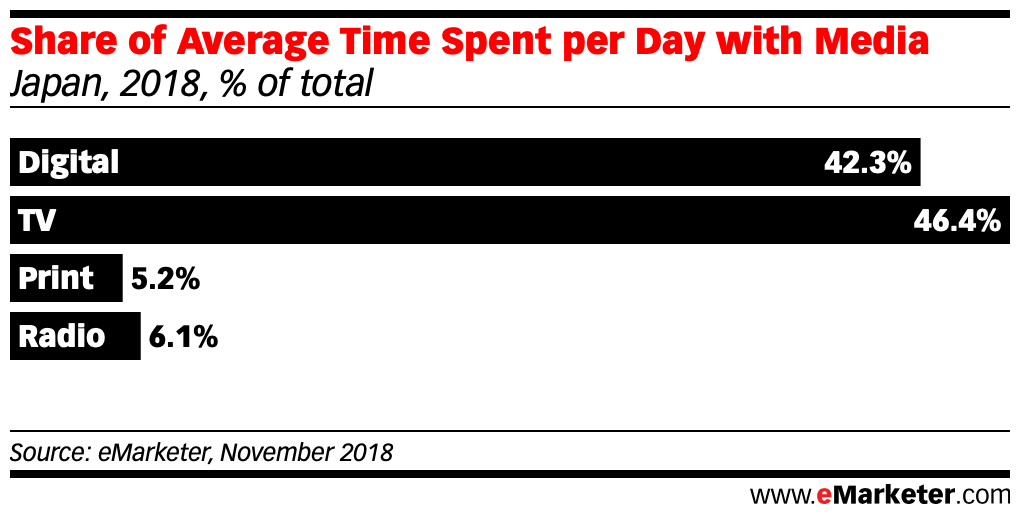

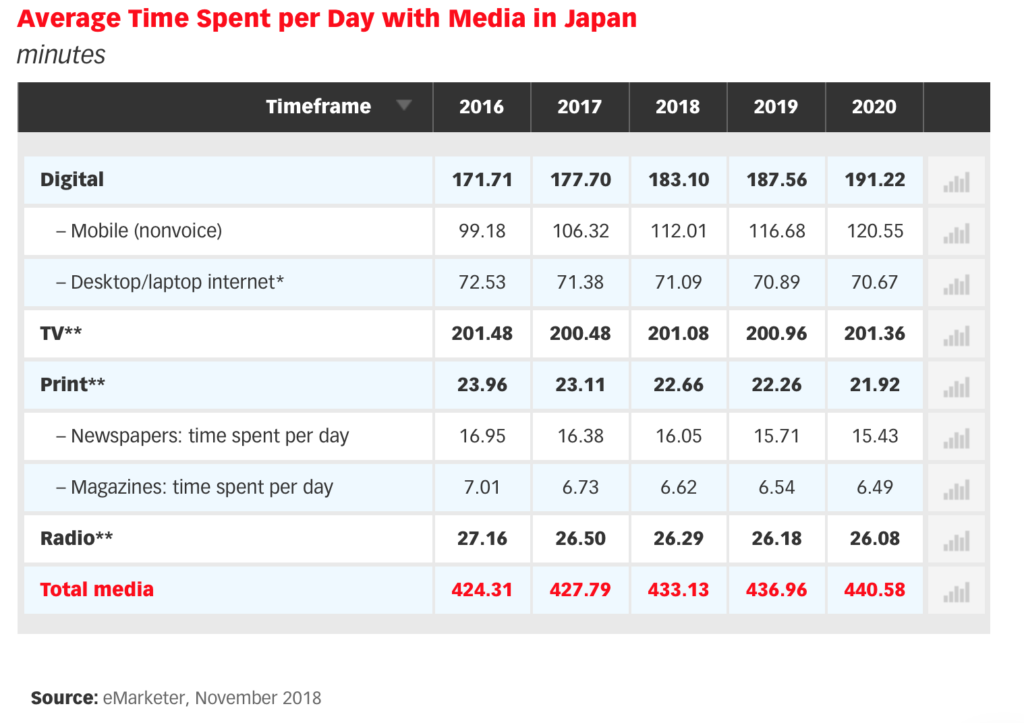

2. TV still commands the largest share of time spent on media in Japan and it is expected to continue in 2020

The total time spent with Media growth is relatively flat over the past couple of years and expected to continue tin 2020

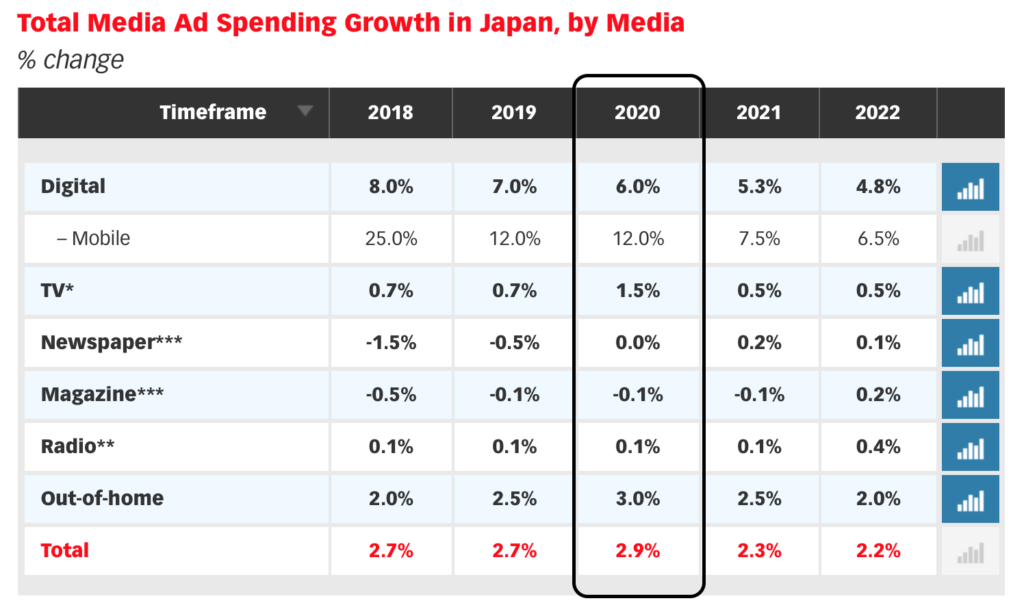

3. Total media ad spend growth in Japan is stagnant at around 2.7% for 2019, the lowest amongst China, South Korea, the US and UK

With the 2020 Olympics, the growth rate increased somewhat to 2.9%

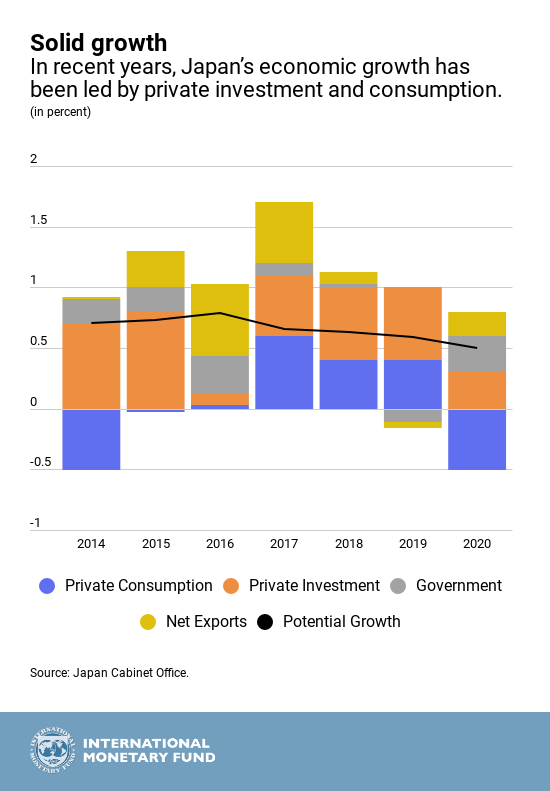

The slow growth in total media ad spend is not surprising given the overall growth of Japan economy (around 1%), according to IMF graph below

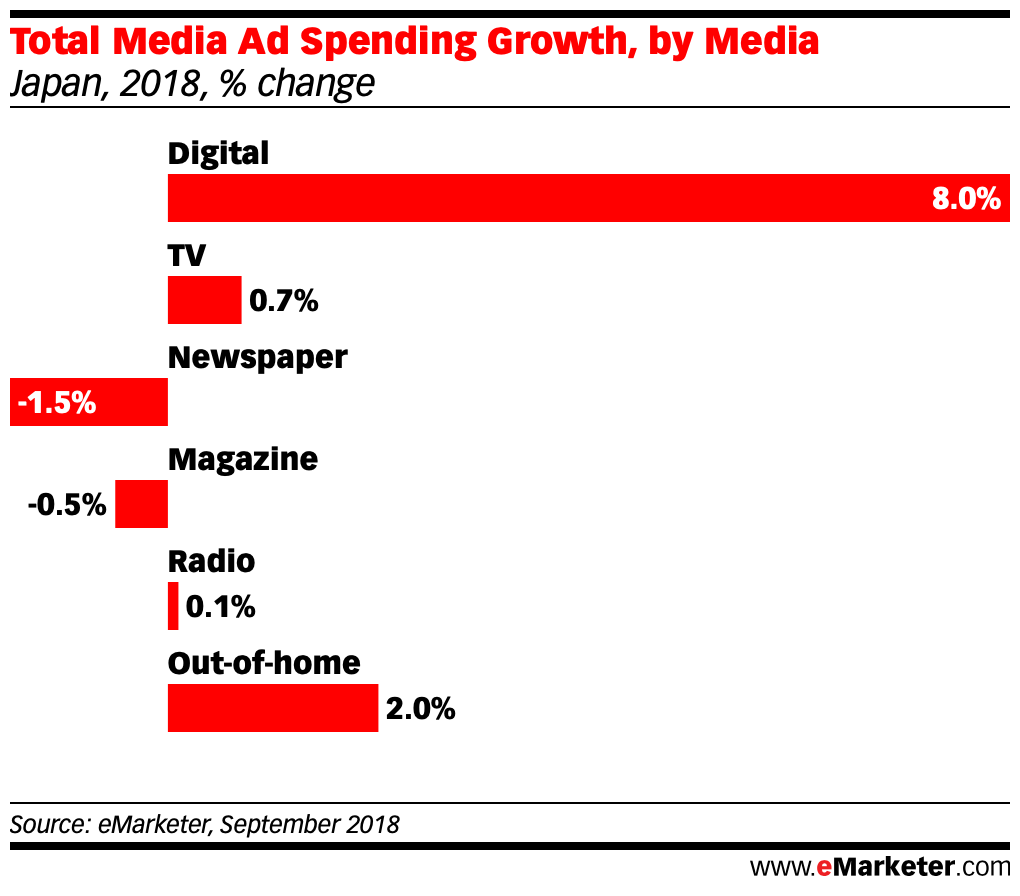

4. Digital ad spend continues to lead growth in ad spending in comparison to TV, Print, Radio, Magazine and Out of Home

With the 2020 Olympics, TV and Out of Home growth are expected to improve somewhat

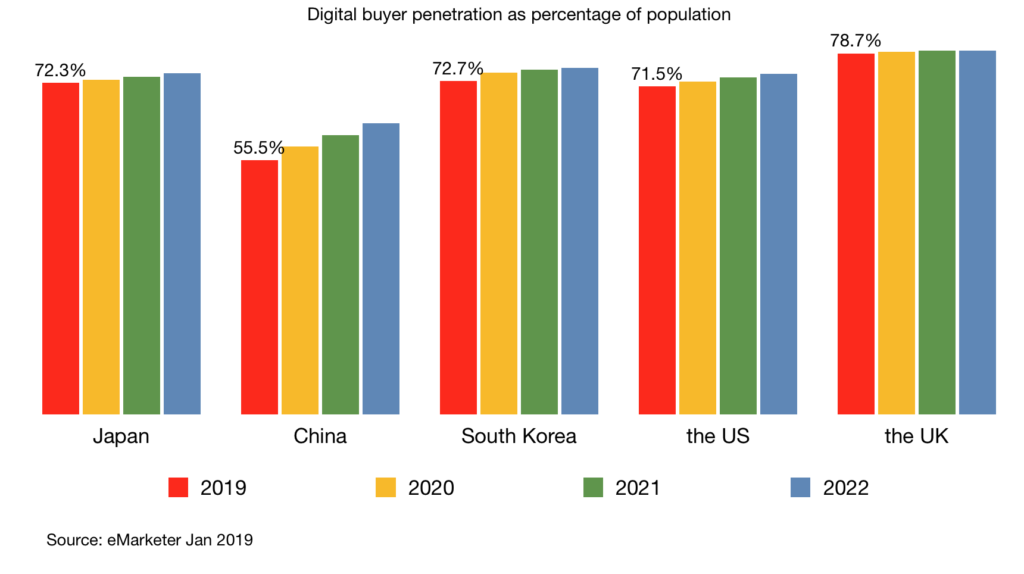

5. Japan is on par with other large economies when it comes to digital buyer penetration and it is expected to remain relatively flat

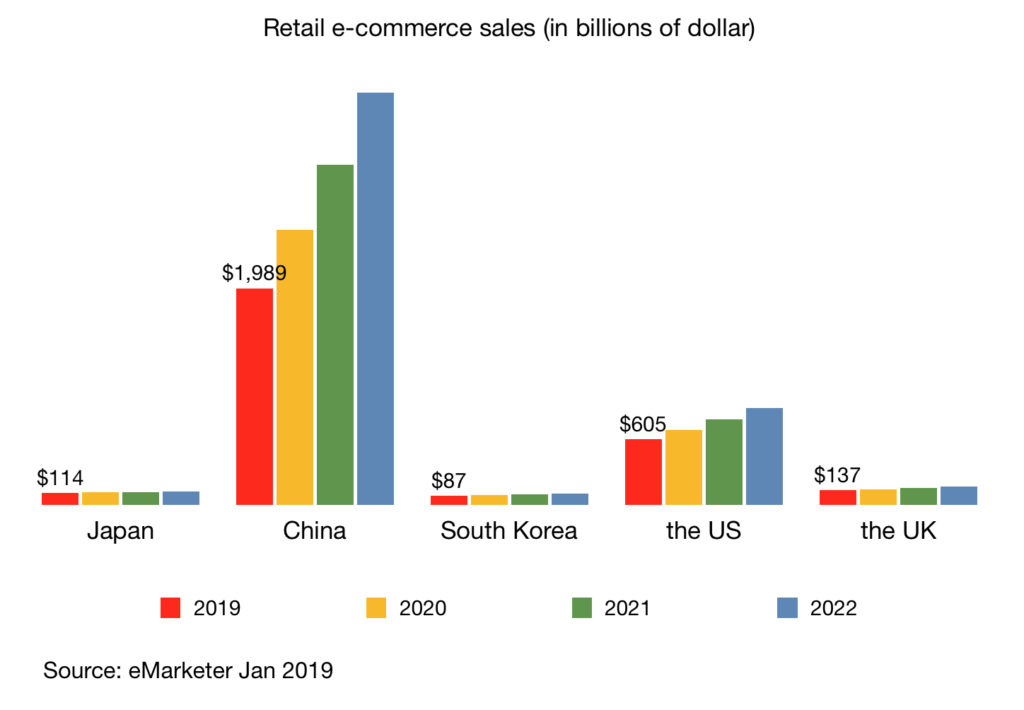

You may notice that China digital buyer penetration is relatively lower. Given China’s scale, this is not surprising. As a market, China e-commerce is larger than Japan, South Korea, the US and the UK combined.

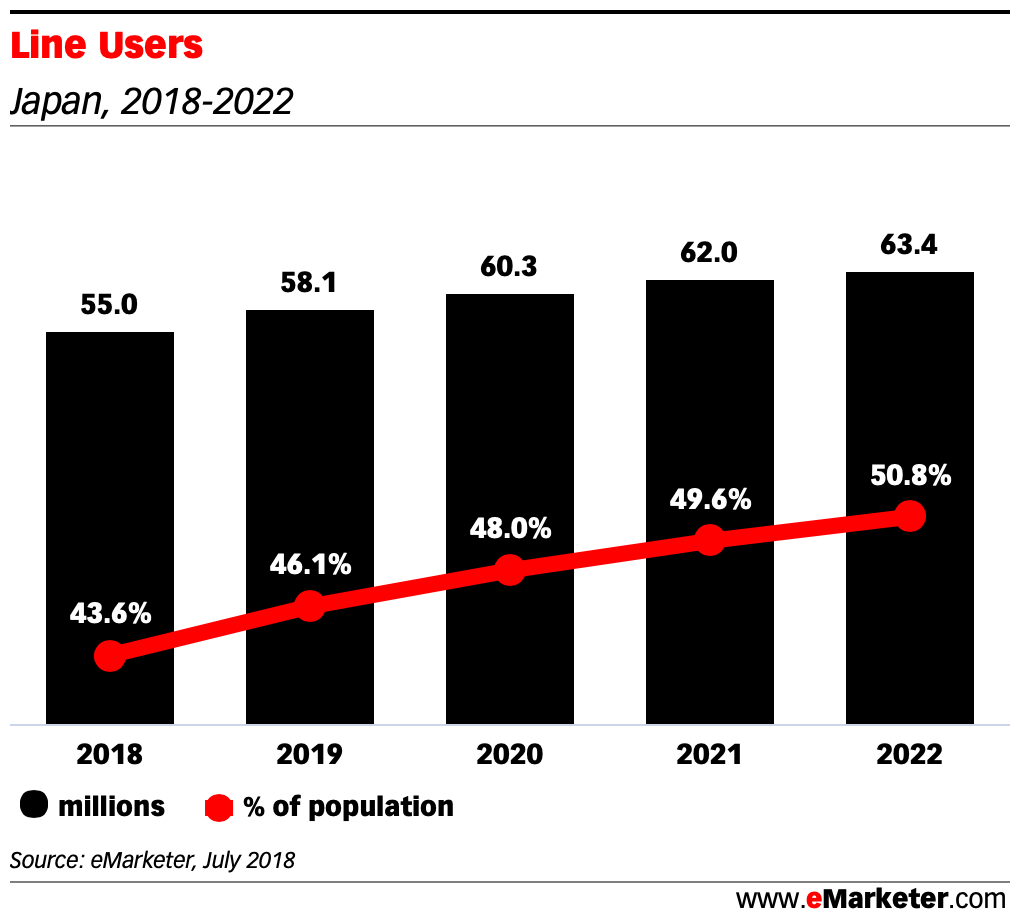

6. Without a doubt Line is the most popular mobile messaging app in Japan

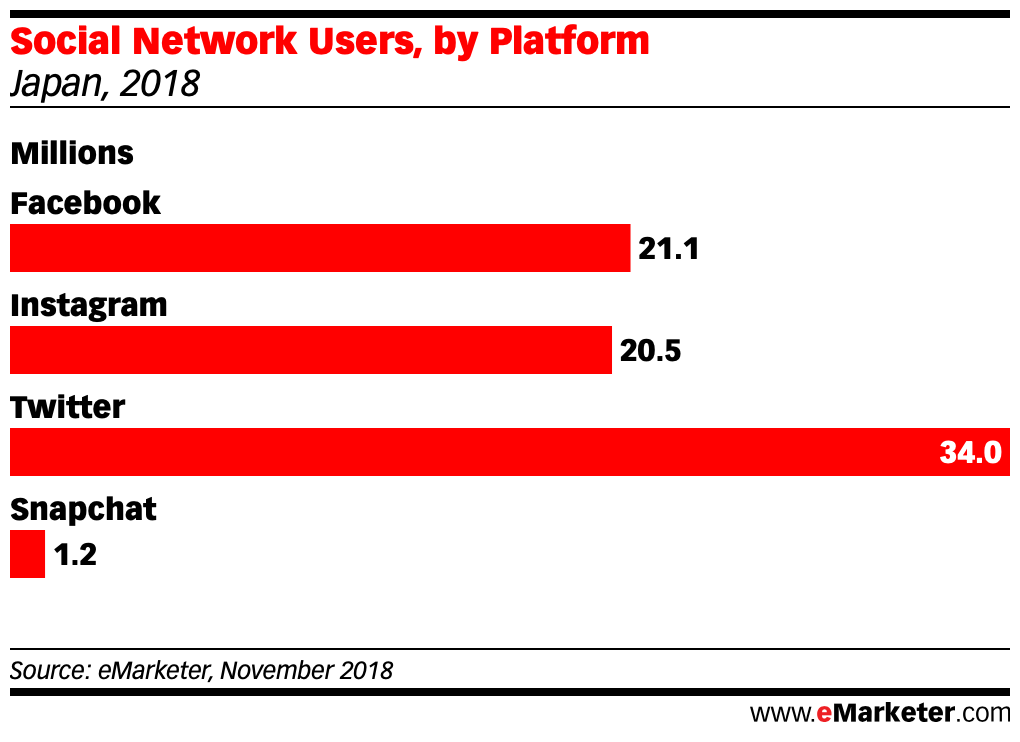

From a traditional social network POV, Twitter dominates the market

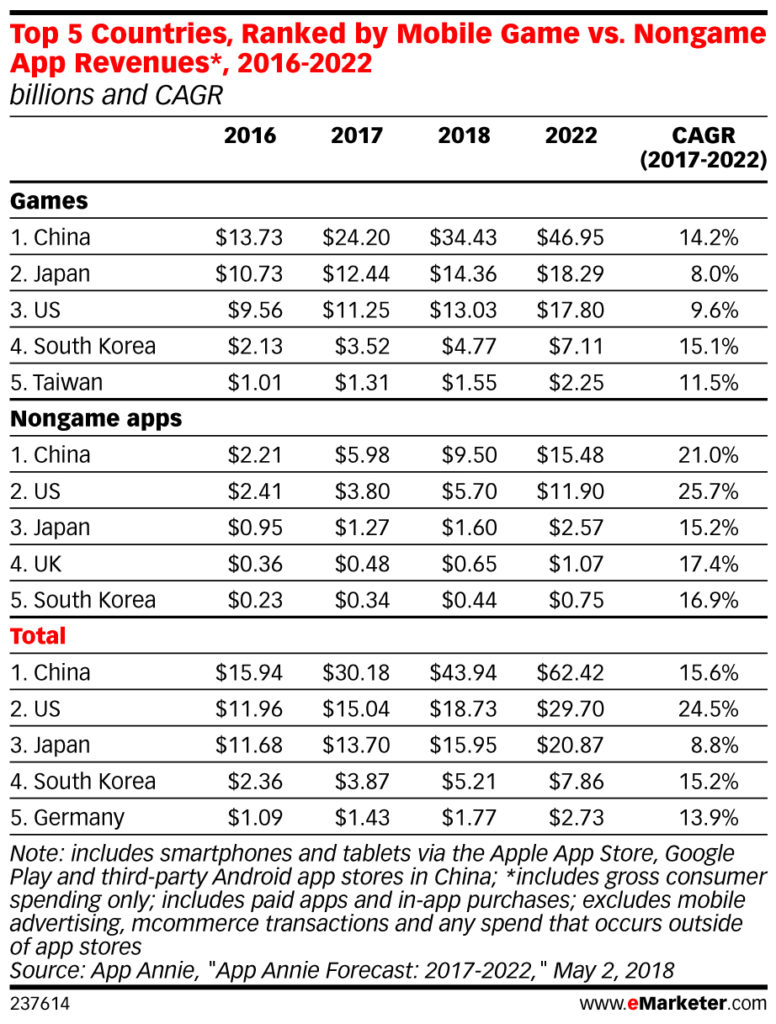

7. Japan ranks number 2 in the world in terms of mobile games revenue

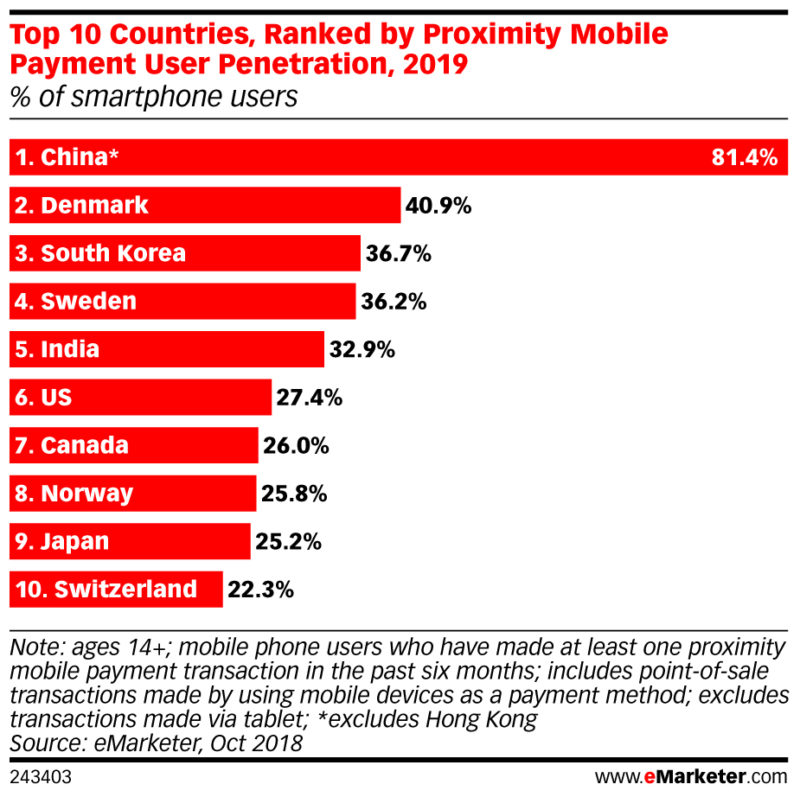

8. Japan is number 9 in the world for proximity mobile payment penetration

That’s it from me. If you have any questions, feel free to drop them below

Thanks,

Chandler