This post is part of the series about Japan that I have been writing in 2019. You can find other posts here:

Key facts about Japan Digital Landscape (updated Jan 2019)

8 key facts about Japan Mobile Game Industry (update Mar 2019)

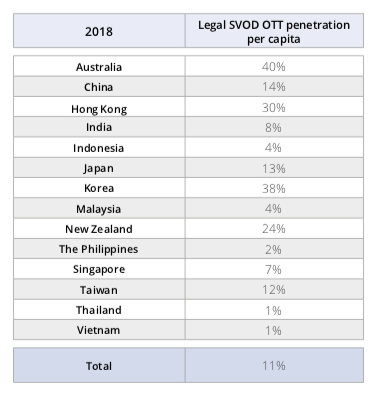

1. Subscription Video on Demand (SVOD) penetration in Japan is at 13% per capita, lower than that of China, South Korea, Australia

The graph below is from Asia Video Industry Report 2019 from AVIA

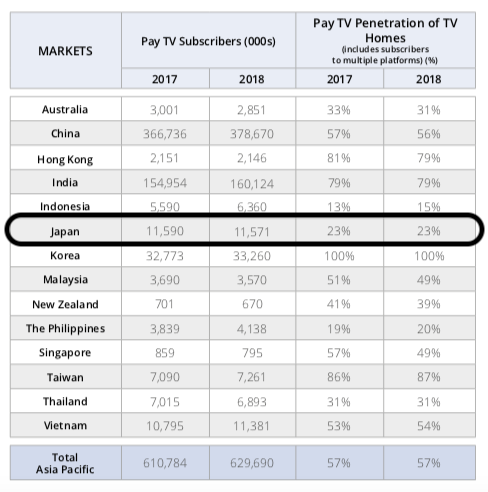

Perhaps it will be less surprising when we learn that Japan Pay TV penetration is also amongst the lowest in Asia Pacific according to the same report.

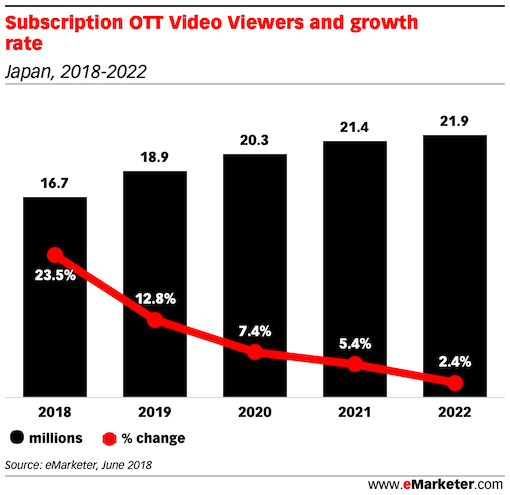

2. The SVOD industry is expected to grow at around 12% in 2019 but growth is forecasted to decelerate quickly

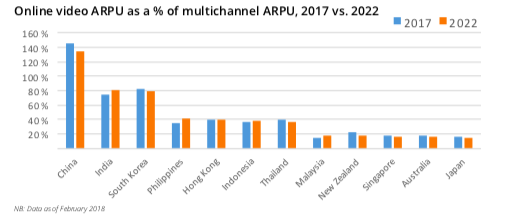

3. OTT subscription revenue is expected to remain at relatively low level (10%) versus multi channel revenue while China is at 100% in 5 years

Data from S & P Global market intelligence and AVIA in the same above report.

This is because average revenue per user (ARPU) for SVOD in Japan is significantly lower than multi channel service ARPU

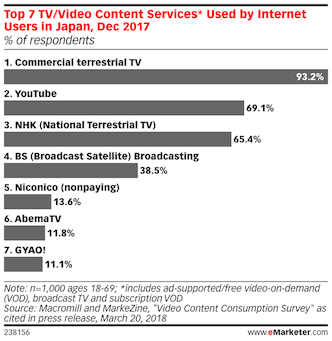

4. Commercial terrestrial TV, YouTube, NHK, BS Broadcasting are the top TV/Video content services used by internet users in Japan

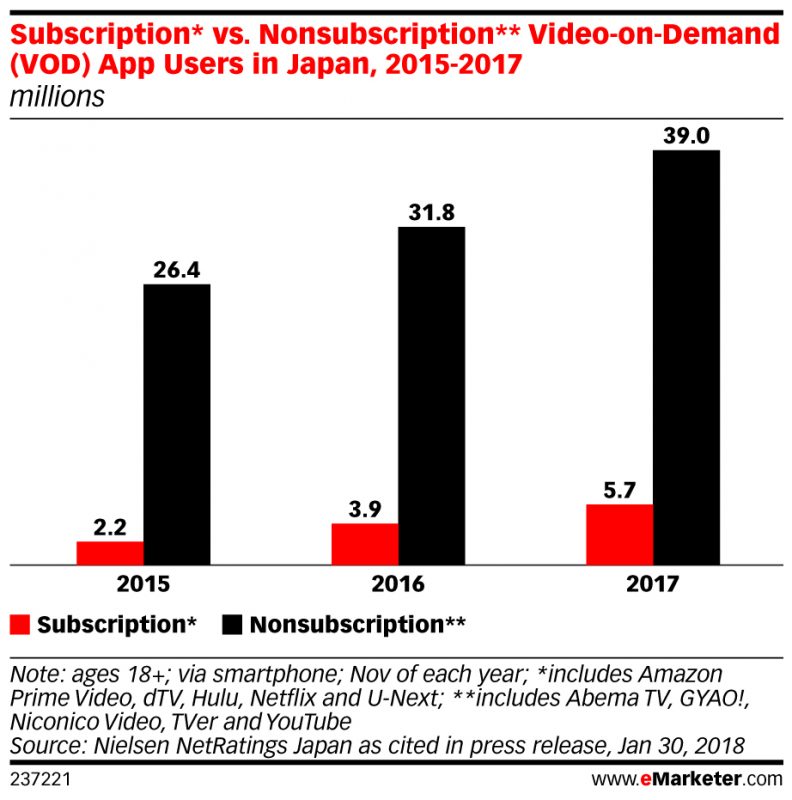

5. Amongst VOD app users, 80% are non subscribers

6. Amazon Prime Video is the leading SVOD service in Japan

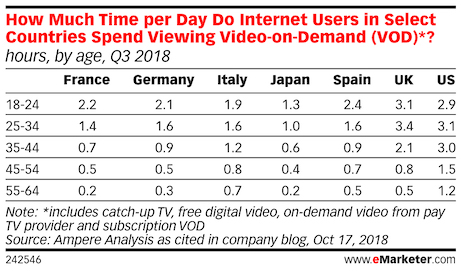

7. Japanese internet users spend less time per day viewing VOD versus users in other mature economies

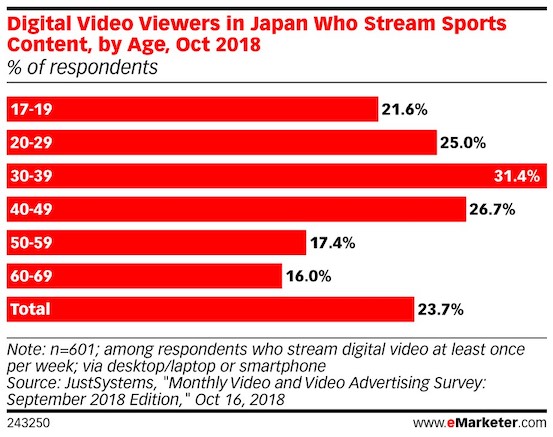

8. The percentage of online video streamers for sport content in Japan is slightly better than market average. However, given the country old population pyramid, the industry faces strong headwind

Thanks,

Chandler