If you live in the US, you have probably heard or visited the treasury direct website before. It is the US government website where you can buy treasury bills, bonds, saving bonds, and more. I have heard podcast hosts/ads saying that the website design is from the 1990s, and they don’t like it. I think the website design and functionalities are fine. It works for me. And this article will explain more.

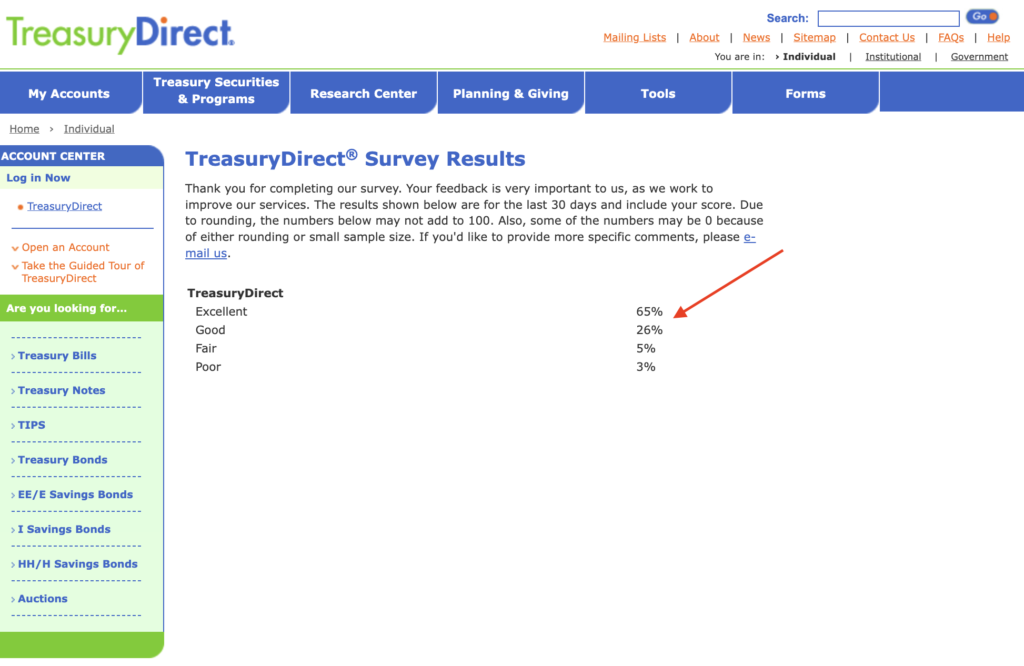

90% of people rate the TreasuryDirect website as excellent or good

Yes, it is not just me, but 90% of people who have visited the TreasuryDirect website over the last 30 days rate it as “good” or “excellent.”

For additional context, after you log off from TreasuryDirect, they ask you to rate the service and the above is the result. You can see the screenshot of the survey question below:

TreasuryDirect serves its main utility functions well

While I am not a design expert, so I can’t comment on whether the TreasuryDirect design is “from the 1990s”, I can say with personal experience that I can complete what I want to do on the website with minimum hassle. The website design and functions work as expected i.e.:

- I can register and open an account with TreasuryDirect

- I can link my checking/savings account with my TreasuryDirect account for buying/redeeming Treasury Bills/bonds easily

- The reinvestment setup is intuitive enough

- The minimum amount they allow for buying Treasury bills is as low as $100 so that is good. For more about why you want to consider buying Treasury bills in 2023, check out this post “Treasury bill: you can earn more than 4.5% APY without state/local tax today”

Basically, my experience with the website is such that it works fine so I haven’t put much thought into it.

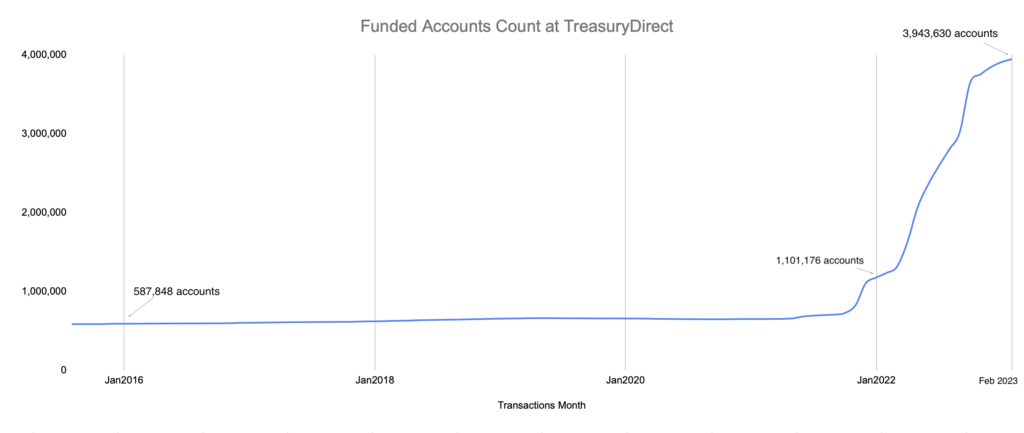

There are close to 4 million funded accounts on TreasuryDirect in Feb 2023 vs. 1 million in Jan 2022

With the rising interest rates, more and more Americans are going to the TreasuryDirect website to buy government bills, and bonds. As of Feb 2023, there are 3.9 million funded accounts with TreasuryDirect.

(Funded accounts are Treasury Direct accounts containing holdings.)

You can see the 4x jump from about 1.1 million funded accounts in Jan 2022 to 3.9 million in Feb 2023.

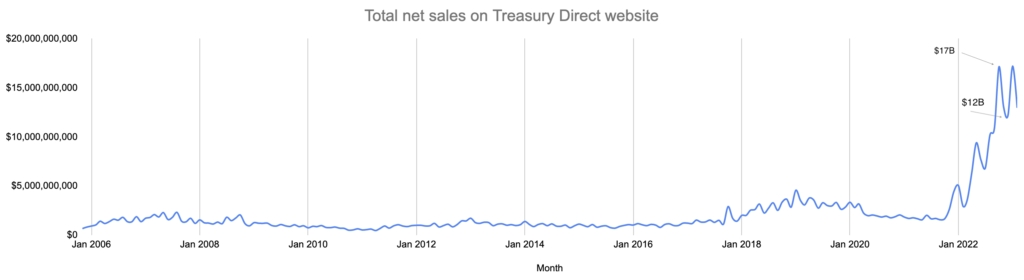

And here is the total net sales transacted on TreasuryDirect website over the years from Jan 2006 (before the great financial crisis) until Feb 2023. As you can see the sales increased 3x over 2022 alone.

So again, if the website is so bad, why do people use it to buy Treasury bills/bonds/notes and not other brokerage services?

Be aware of ulterior motives

So the next time you hear someone claiming (in their advertisement/podcast) that the TreasuryDirect website is sh*t, or from the 1990s, don’t take their word for it. Ask yourself what they are trying to sell you, what are their interest?

Also, it is “popular” in the US to sh*t on government services. And many of them are indeed bad, very very bad. But it is not this case, this website, with its basic functionalities targeting retail investors.

Also, be aware of gimmicks/design and notification tricks to lure you into opening up your investment/saving app often and feel like you need to “do something.” Every time you “do something”, the broker earns something, typically. Brokers don’t earn any money when people just sit and transact only once every quarter/six months or a year.

Have I done a comparison between TreasuryDirect and other brokerage websites?

Nope, I haven’t. Because as mentioned above, the TreasuryDirect website works fine for me, and so do other brokerage websites that I didn’t think about comparing them. This article is not trying to convince you to set up a new TreasuryDirect website. If you are happy with using your current brokerage account to buy treasury bills/bonds, by all means, continue.

Last but not least, don’t take my word for it either. Try the TreasuryDirect website out and let me know what you think below.

Chandler

P.S: if you wonder why I don’t mention the specific names of podcast hosts or ads on this post, it is by design.

P.S.S: Yes, I am old enough to remember what the internet was like back in the late 1990s. It was slow, very slow back then and we had a lot of pop-ups 😀

[jetpack_subscription_form]

I just tried to log in 5 times 30 minutes apart , each time I get 70% through the process is says Error, try back later. Worst website ever.

sorry to hear that. It is strange that you experienced it like that. Mine was and is quite different and smooth.