How to apply Ray Dalio's sharings to your personal finance?

I've learned to apply Ray Dalio's big cycle insights to my personal finance by prioritizing debt reduction and defensive positioning—here's how you can prepare for the volatility ahead.

I am a big fan of Ray Dalio's sharing and recommendations. I have been reading his books, articles on LinkedIn, and watching his Youtube videos. Recently, Ray has been sharing a series about the Changing World Order and lessons learned from the big cycles over the past 500 years. He also appeared on Bloomberg to share his thoughts about the Economy, Pandemic, China's Rise. This interview is similar to a discussion Ray had with Jim Haskel on Bridgewater Associates' Youtube channel about "Managing Money in a Zero Interest Rate Environment".

Ray's sharing has many implications for the world economy, policymakers, investors, etc. At a personal finance level, his main recommendation is diversification. This post is about how I interpret his recommendations and apply them to personal finance.

Update for 2022: since this post was written back in 2020, I updated it again for 2022 here.

1. Basic level: pay your debt, especially those with 10%+/year interest rate

If you accept the probable reality that potential return on most assets in the next 10+ years is going to be lower than the past, it makes sense to first pay/reduce your debt level. The logic is quite simple. At an interest rate of 10%+/year, the amount of money you plan to invest, is better spent on reducing your debt. Because the investment return is likely lower than 10%/year over an extended period of time.

Most credit card debt in the US (or in many other countries) has an annual interest rate of 16%+ so pay them as soon as you can. Better, don't incur credit card debt, and pay the balance on time.

2. Be a bit more defensive in your approach, given the continued volatility

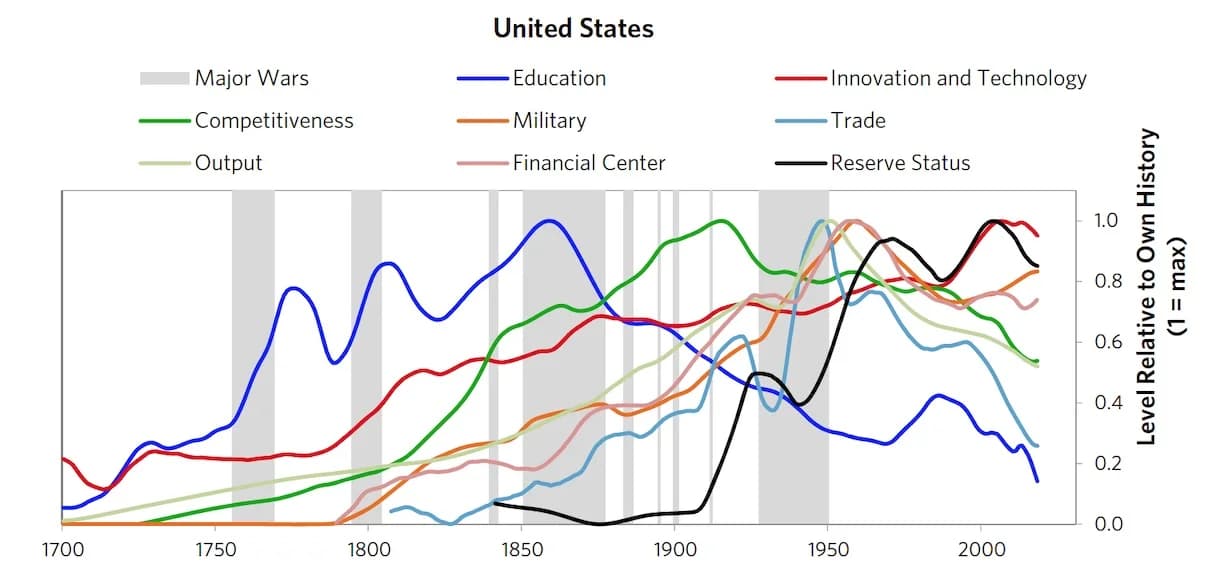

Ray has been saying that this period is very similar to the 1930s-1945 period in history. He recently indicates that he believes we are around the year 1937 - 1938 from a long term debt cycle perspective. So we should expect lots of volatility ahead, including:

- Wars: trade war, technology war, capital war between the US and China. There is a considerable amount of pressure from the US to US allies too so the trade/technology wars may include many other countries, even if they don't want to take part in it.

- Gaps: wealth gap, value gap, the political gap within the US, and many other western countries.

- Conflict: The above gaps lead to more intense internal conflicts (culture war) within a country and between countries.

So we should be more defensive in our personal finance approach. Review our income and balance sheet (savings) and take a more defensive stand. I would clarify that being defensive/offensive is not a binary choice but a continuum and we should be more defensive than before.

For example:

- Even with 0% interest debt, try to reduce them a bit more if you can't find a suitable investment opportunity. For example, if you have a monthly installment plan to pay income tax, consider fast track the plan, pay more per month.

- Keep enough cash (cash equivalent) to cover your household expenses for at least 6-12 months in the event that your monthly income stops aka liquidity is important.

- The probability of losing your monthly income (from your job or rental income, etc.) is different for each person, but it is there. So each of us needs to evaluate and decide for ourselves.

- I don't see this point being contradictory with Ray's saying "Cash is trash". This is about being & feeling secure, being able to meet any immediate financial needs you may have.

- Ray talks about liquidity here in the "The Way Forward Conference" (minute 15:58). Net net, liquidity is going to be very important.

- Avoid negative monthly negative cash flow. You have a negative monthly cash flow when your monthly income is smaller than your monthly expense i.e. using savings to fund your spending.

3. Diversification in asset class, geography, currency

For asset class diversification, I follow the guidance from "All weather strategy" from Bridgewater also known as Balanced beta investing. A few important callouts: (you will find them through the above videos from Ray Dalio)

- Given that the interest rate from government bond is 0% or negative for a foreseeable future, it is not advisable to own government bonds.

- The US Federal Reserve, European central bank, and many other central banks in many advanced economies are continuing to print a lot of money or what they call "quantitative easing". So over time, the value of money as a store hold of wealth is reducing.

- For each asset class, I will avoid picking an individual company and stick mostly with index investing.

- Under "balanced beta investing", Ray and his team cover: equities, commodities, corporate credit, emerging market credit, inflation-linked bond, etc.

Since Ray is saying that "Cash is trash" because of its diminishing function as store hold of wealth, then what is? Bob Prince, co-chief investment officer for Bridgewater Associates, shared a bit more details during a Bloomberg Live interview about one week ago "Bridgewater Co-CIO Prince on Global Markets Outlook" (minute 13:25). Some alternative recommendations are gold, inflation-linked bond, etc. However, the gold price has been rising steadily over the past 5 years, approaching the highest point over the past 15 years, so it is not a simple buying decision.

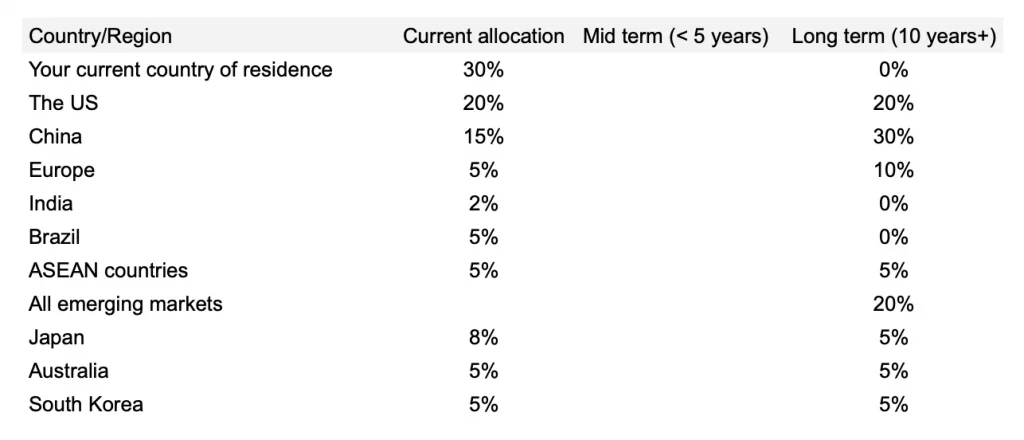

For geographic diversification, there is no easy formula. Personally, a number of countries, regions are in my consideration set like:

- The US

- China

- Emerging markets

- Europe or Germany alone

- The UK

- Japan

- Australia

- Subsets of emerging markets like ASEAN countries, India, Brazil

Market timing is not a good thing and I am not trying to play that game. However, I do see that at certain points in time, the price of certain asset is getting really high so to achieve geographic diversification and avoid paying too high price, I have a short term reality and a mid to long term diversification goal.

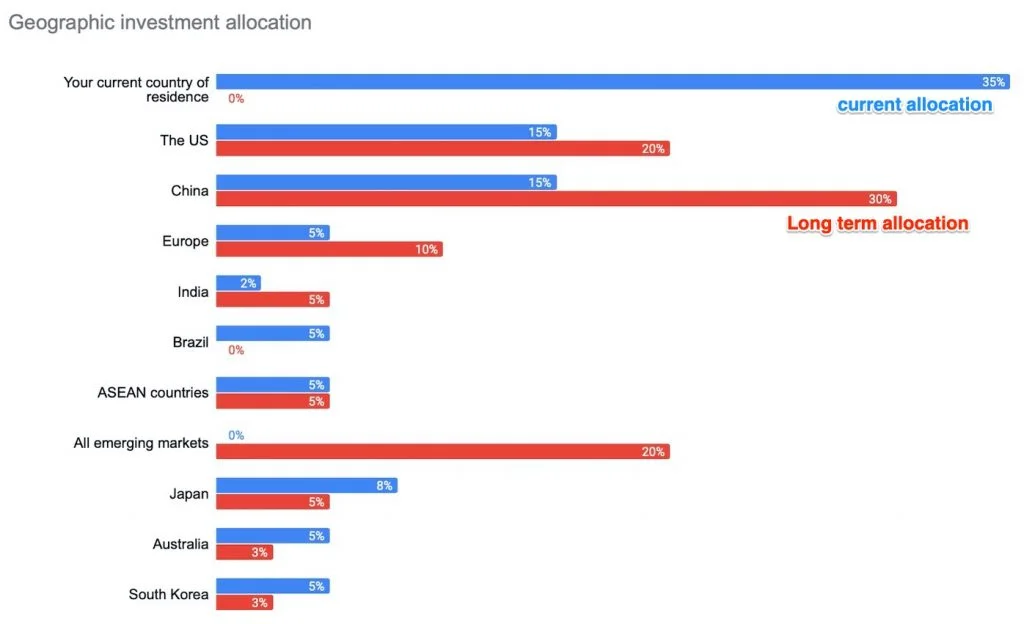

Below is a dummy example of how I see my portfolio from a geography POV, between current allocation, mid term and then long term allocation goal. (data is not real of course)

Geographic diversification can give you currency diversification too if you work with suitable brokers and execute your orders in local currencies.

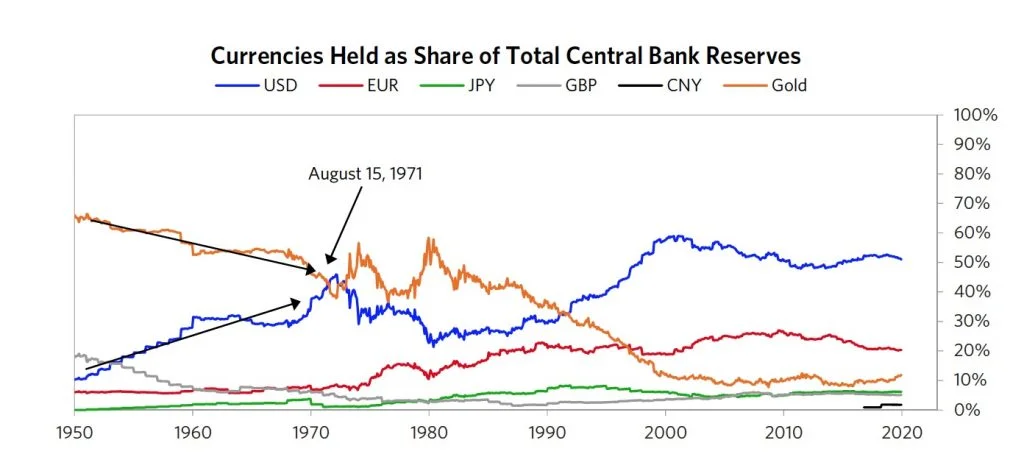

Below is a good graph from Ray Dalio and his team about the currency situation:

Graph from "big cycle of the United States and the Dollar, part 2"

4. Build a simple personal finance dashboard

It is a personal choice, sometimes, seeing the same information in graphs may help so I recommend building a simple personal finance dashboard to track critical information.

For example, with geographic diversification, we can have the below graph

The same approach can be used for asset class diversification, or currency diversification.

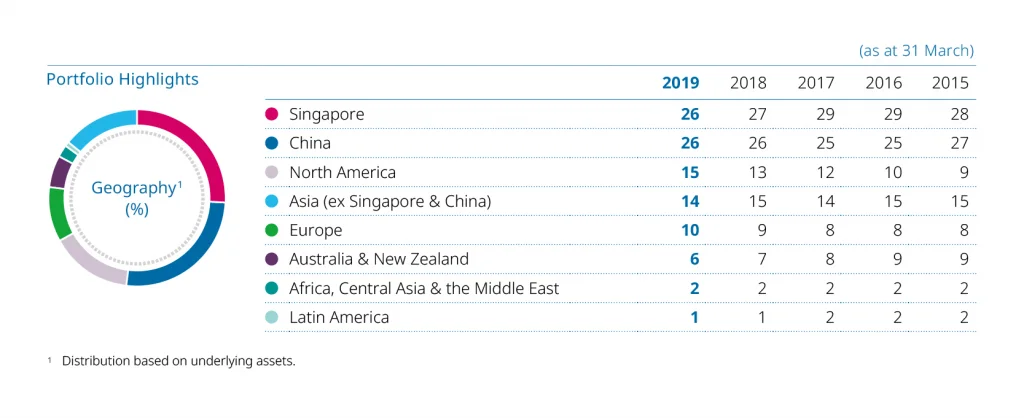

5. Example of portfolio dashboard from Temasek

For those who don't know about Temasek, "Temasek is a global investment company headquartered in Singapore", owned by the government.

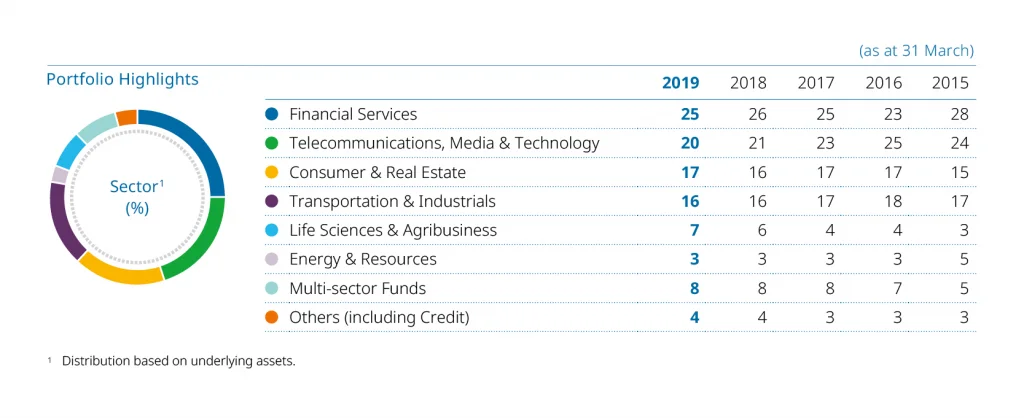

Portfolio highlights from Temasek are visually appealing. Some examples are below:

Graph taken from Chart Centre on Temasek website

From a geographic diversification point of view, personally I don't think it will structure my portfolio with the weightage above with too much weight for Singapore. However, I do understand why Temasek is doing so vs an individual investor.

From the graph, you can also see the trend over time with reducing weight for AUNZ, stable percentages for China, Asia, etc.

Graph taken from Chart Centre on Temasek website

It is not difficult to build a dashboard to include these graphs. You can use excel or Google Sheets or Numbers.

That's all from me. Let me know what you think. Do you agree/disagree or have any general comments?

Chandler

More from this series

- The Changing World Order: Ray Dalio's insights — the main hub with all updates

- Ray Dalio's 2024 Great Powers Index — the latest analysis

- Applying Ray Dalio's recommendations to personal finance