My reaction to Ray Dalio's post "China’s “Dangerous Storm” Coming: The Eight Big Challenges Facing China and the People Chosen to Deal with Them"

Ray Dalio and Kevin Rudd agree on China's shift toward state control, but I found one crucial insight that reveals why foreign investors shouldn't panic yet.

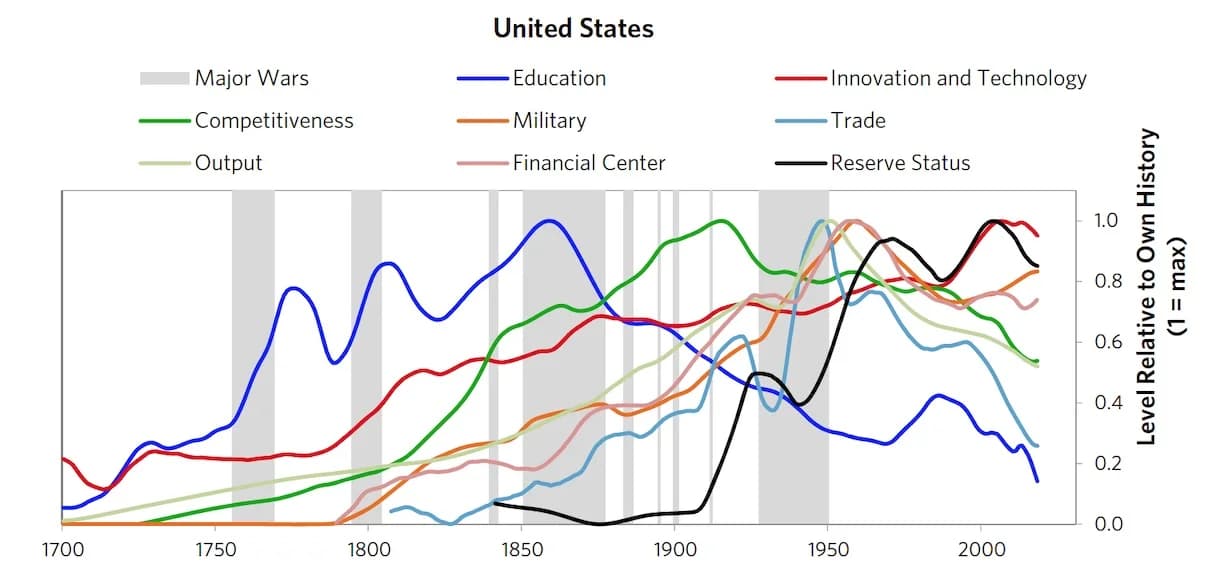

Recently, Ray Dalio published another article in his series, "The changing world order."

My overall reaction to his post is:

Ray's view is comparable to the perspective Kevin Rudd has publicly expressed in recent years. (If you haven't been keeping up with Kerin Rudd's public appearances and statements, his recent book the avoidable war is a great place to catch up.) This is both positive and negative. On one side, we have two distinct and seasoned experts on China who tend to agree with each other about Xi Jinping's worldview/general method and how the Chinese system operates. However, this isn't so great for foreign investors because of what they agrees implies.

What do I mean by that?

- Chinese economy is moving more and more to the left (Kevin Rudd) i.e. "from being more supportive to free market economics in pursuit of prosperity to being more supportive of state-controlled economics" (Ray Dalio)

- State owned enterprise (SOEs) in China traditionally have not been as productive as private enterprises (Kevin Rudd).

- According to Ray: This environment of great controls and great risks is leading decision makers in all areas to be more inclined to not make decisions than to make decisions that could be perceived as bad ones. This is negative for growth and improvement. People are walking on eggshells, which has made political and private sector decisions very difficult.

- Ray believes that Chinese leaders believe that "companies need to work for the country’s overall well-being more than have exorbitant profits converted into huge personal gains while people are suffering." While this is good for the overall system, it also means limits on the level of profits private enterprises can make.

The eight big challenges of China that Ray mentioned are very similar to what Kevin has been saying too.

Now here is the piece of good news that I agree with Ray based mostly on what I have read elsewhere: "While important changes are in the works to get the balance between capitalism and communism right, many people who aren’t informed mistakenly view this move as an abandonment of capital markets and entrepreneurship. That couldn’t be farther from the truth. It is now well-accepted among Chinese leaders that entrepreneurship and efficient capital markets are good for China. Still, the perception of the risk for capitalists and capital markets is having a negative effect on markets."

This is good news because it means that the Chinese government is still supportive of private enterprise and capital markets, despite recent moves to increase state control. I think this nuance is often lost in mainstream Western media coverage of China. For those who know me, I am fascinated by China and have been following these developments closely for years. The reality is more complex than the headlines suggest :)

So overall, I agree with Ray Dalio's general assessment of the situation in China, and I think anyone interested in this topic should read both Ray and Kevin Rudd's work to get a well-rounded view. I might be wrong about some of the above -- I am a student in this subject, not an expert.

What do you think about the direction China is heading? Do you agree with Ray and Kevin Rudd's assessment?

Cheers,

Chandler

P.S. Here is my review of Ray's book "Principles for dealing with the changing world order"

More from this series

- The Changing World Order: Ray Dalio's insights — the main hub with all updates

- Ray Dalio's 2024 Great Powers Index — the latest analysis

- Applying Ray Dalio's recommendations to personal finance