The Alarming Probabilities of Disruptive Conflicts and Wars, as Predicted by Ray Dalio

Ray Dalio estimates a 35-40% chance of disruptive civil and international wars in the next decade, alongside a 60% probability of major debt restructuring in reserve currencies.

Ray Dalio just posted part 2 of the Two-Part Look at 1. Principles for Navigating Big Debt Crises, and 2. How These Principles Apply to What’s Happening Now.

As per usual, his post is long and detailed :). One of the reasons behind the length/level of detail of this post is that Ray wants to make sure you can understand his reasoning and articulation, even if you haven’t read any of his books or watched previous videos on Youtube.

Now, if you are like me, who have read the book “Principles for Navigating Big Debt Crises” and watched the “How the economic machine works” video, it is likely that 3/4th of the content of this post can be skipped. But this doesn’t mean that I don’t find this post useful. Here are what I have learned from part 2:

- Ray Dalio explains the coordination of monetary and fiscal policy through Monetary Policy 3, which allows the central government to control money and credit by having the central bank buy its debt with printed money. This happened in 2020-2021 due to the COVID crisis and political changes, resulting in a large increase in government spending, fiscal deficits, and debt sales, leading to a big easing in monetary policy and the formation of new bubbles.

- However, this monetary easing resulted in higher inflation, causing the pendulum to swing back to tightening, leading to a rise in interest rates and a decrease in asset prices.

- Conflicts between the left and right extremists, as well as between international powers, have intensified, but have recently been restrained. The US sanctions against Russia were ineffective and have led to concerns about holding dollar debt assets, but the internationalization of the RMB has not yet driven markets. The ways these conflicts have played out in 2020-2022 have given indications of future alignments and the benefits and risks of various countries. The three criteria for identifying countries that will do well in this new environment are strong income statements and balance sheets, internal order, and unlikely involvement in international conflict. (Chandler’s note: I am surprised

- There has also been a shift in wealth from central governments and central banks to the private sector, which has cushioned the negative impact of tightening. The vulnerability of the dollar and dollar-denominated debt has been increasing due to factors such as the supply of dollar debt outpacing demand, foreign countries seeking to diversify their holdings, US sanctions and political conflicts, and more trade and capital transactions with China being denominated in RMB.

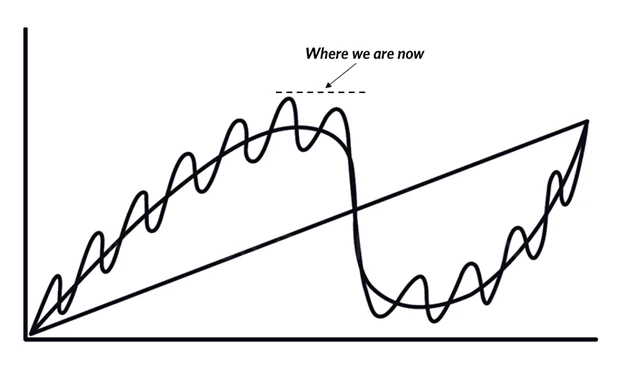

- Ray Dalio emphasizes the importance of diversification in investing, given the uncertain future. He believes that the current stage of the global financial and economic cycle is near the brink of a crisis, along with the start of a costly climate crisis, but also near breakthrough technological advancements.

- He predicts that central banks will face difficulty in finding a balance between satisfying lenders and not hurting borrowers as they strive for stability.

- He also estimates a 60% chance of a major restructuring of debt assets and liabilities in the major reserve currencies within the next 10 years.

- In terms of internal and external conflicts, Dalio estimates a 35-40% chance of a disruptive civil war and international war over the next 10 years, though he doesn't expect a full-scale military war between nuclear countries. He cautions that his estimated probabilities are unreliable, given the increasing risk levels and the number of militarily powerful countries.

- Ray Dalio thinks that acts of nature, most notably climate change, will be very costly in one way or another.

- He believes that the technological advancements fueled by AI will lead to shocking advances in many areas in the next 10 years, but the profit from these investments is not clear.

That’s all from me. Those probability numbers are sobering, to say the least T.T

Have you read Dalio’s original post or his book on debt crises? I’m curious whether his framework has changed how you think about your own investments or financial planning. Let me know what you think.

Cheers,

Chandler

More from this series

- The Changing World Order: Ray Dalio's insights — the main hub with all updates

- Ray Dalio's 2024 Great Powers Index — the latest analysis

- Applying Ray Dalio's recommendations to personal finance