Expat Home Buyers: Navigating the Impact of Rising Interest Rates on U.S. Mortgages

Most homebuyers only compare monthly payments to rent, but at 7% interest, you'll pay over 80% of your loan amount in interest alone—here's how to avoid that trap.

This post was written in 2023. Some details may have changed since then.

As expats who relocated to the Bay Area, buying a home in the US has been something we have been thinking about. I have to admit, coming from Singapore where the mortgage system works very differently, the US mortgage landscape was confusing to me at first. One thing I noticed is that many people — including us initially — only compare the monthly mortgage payment to their current rent. But that is not the full picture. With interest rates at around 7% in 2023, the total interest you pay over the life of the loan is staggering. Let me walk you through what I learned.

Demystifying Mortgage Calculations

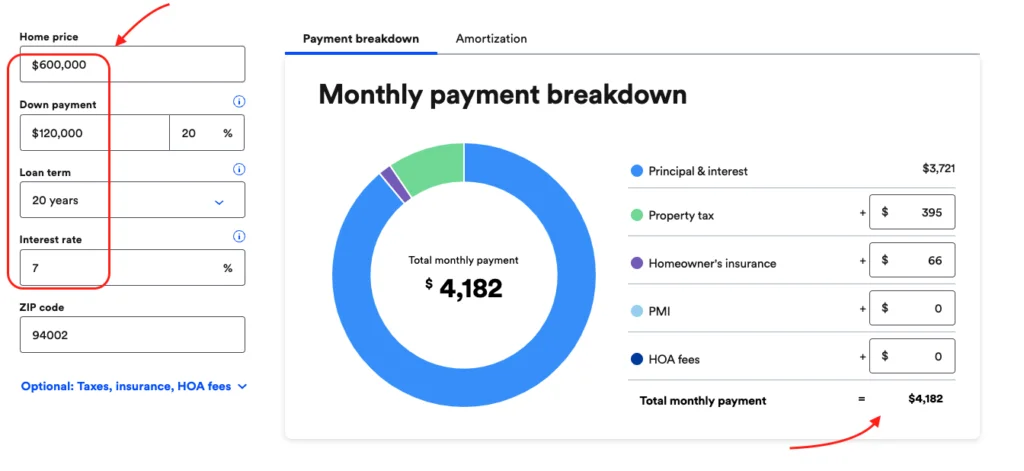

Mortgage calculators are handy tools for understanding your potential financial commitment. Let's walk through a simple example using a mortgage calculator from Bank Rate.

Let's assume:

- Target home price: $600,000

- Down payment: 20% ($120,000)

- Loan term: 20 years

To get an accurate monthly payment, you'll also need to input your zip code and homeowners association (HOA) fees, if applicable.

Some of you may stop here and just look at the monthly payment and mentally compare it with your current rent. Don't do that. Check out the Amortization tab.

The Importance of Amortization in Mortgage Loans

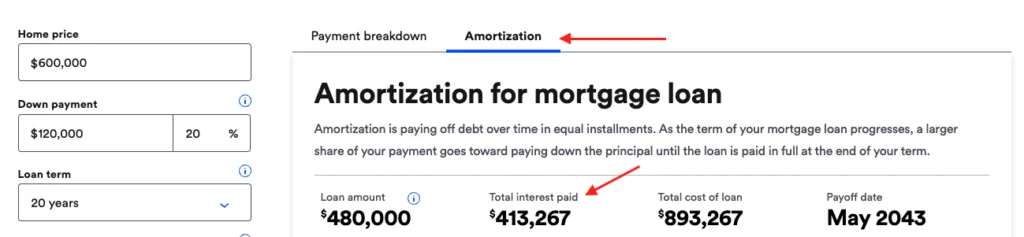

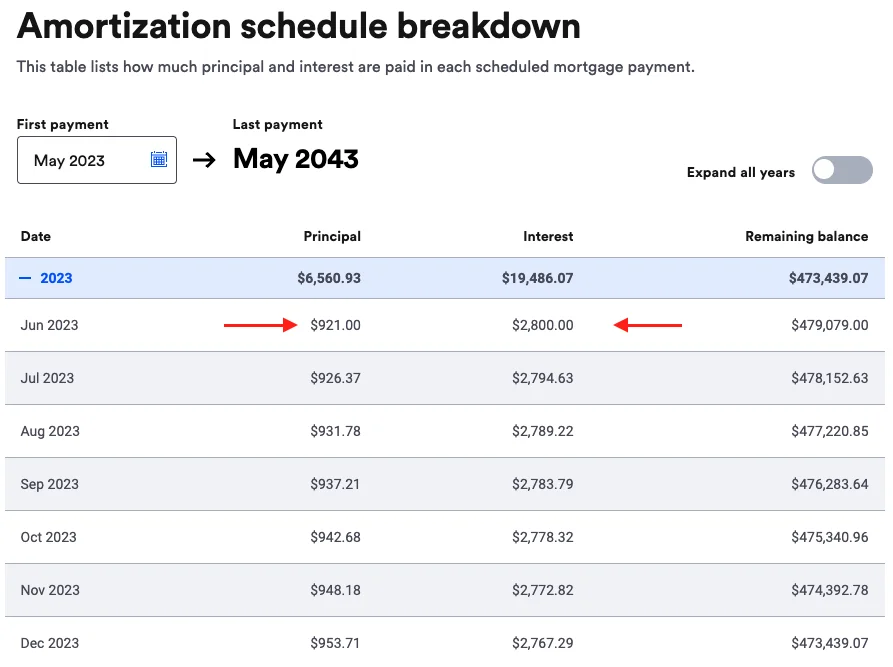

Many people compare the calculated monthly payment with their current rent, but this isn't enough. It's vital to look at the loan's amortization, which shows the total interest paid over the loan's duration.

Take a $480,000 loan over 20 years at a 7% interest rate, for example. The total interest paid is around $413,000 - over 80% of the loan amount! This means that despite a monthly mortgage payment of about $4,100, only around $900 goes towards the principal, with the remaining $2,800 servicing the interest in your first few years.

The Role of Interest Rates in Mortgage Payments

Interest rates greatly influence the total interest paid. The chart below illustrates the total interest paid for the same loan at different interest rates, ranging from 3% to 7%. Just a few years ago, Americans could secure a 30-year mortgage at a fixed rate of about 3%. With rising interest rates, the total interest paid could double at 7%.

Chart: Total interest paid on a mortgage of $480k for 20 years at different interest rates (3%–7%). At 3%, total interest is approximately $160k; at 7%, it roughly doubles to $320k+.

Another way to look at this is to see how the total interest paid compares with the principle loan amount.

Chart: Total interest paid as a percentage of the loan amount for a 20-year mortgage across different interest rates. At 3%, you pay roughly 33% of the loan in interest; at 7%, that rises to about 67%.

There is no one size fit all

Why am I sharing this? Because when we first looked into buying a home here, I wish someone had shown me these numbers clearly. From my experience, many first-time buyers — especially expats — don't look beyond the monthly payment.

A few key takeaways:

- Don't solely focus on the monthly payment when considering a mortgage. Look at the bigger picture.

- Small reductions in interest rates can result in significant savings over the life of a mortgage.

The Possibility of Refinancing

Yes, that is an option and a possibility that you can consider for the future. However, please note that according to the Federal reserve, they are not planning to lower interest rate in 2023 so it may be prudent not to count on refinancing at a cheaper rate in 2023.

Understanding Home Price Fluctuations

One of the best home price index is the Case-Shiller index.

Home prices tend to increase over the long term, but there can be short-term dips. The Case-Shiller Index, a leading home price index, shows that US home prices generally rise over the long term. However, from 2006 to 2012/2013, home prices decreased substantially across the US.

Also, it is better that you check the home price trend of your local area vs a national index.

Conclusion

I think understanding the dynamics of mortgage payments, interest rates, and home prices is really important — especially for expats who may not be familiar with the US system. I am not a financial advisor, so please do your own research. But I hope the visuals and examples above help you see the bigger picture before making such a significant decision.

Are you currently looking to buy in the US, or are you still renting? What has been the biggest surprise for you in the home buying process? I'd love to hear about it.

Cheers,

Chandler

P.S: This article was written with the help of A.I.