Summary of Ray Dalio's Jun 2023 conversations with Thomas Friedman and Bloomberg Invest

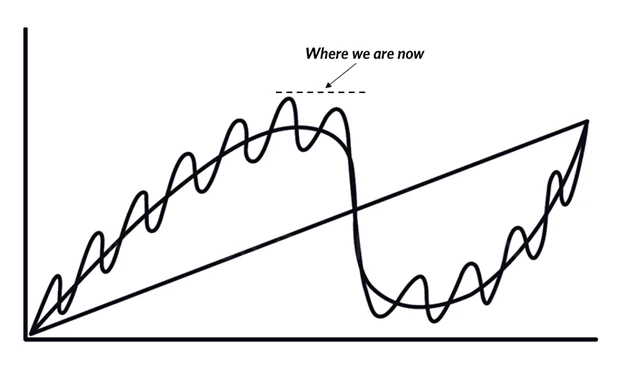

Dalio warns we're heading into a debt crisis within 1-2 years as the Fed must print money to meet bond demand, while the US sits at a cyclical low point needing change.

For those who know me, I've been following Ray Dalio's work for years now — his "Changing World Order" framework genuinely changed how I think about geopolitics and economics. In June 2023, he participated in two conversations that I think are worth watching. They're largely in line with what he has shared before, but what's different this time is he gets more specific about when things might happen — his predictions for the next 1 to 2 years.

Bridgewater’s Ray Dalio Talks Money, Debt, and US Political Landscape Jun 11, 2023

Ray spoke with Bloomberg's David Westin at Bloomberg Invest New York. He explains that interest rates must be high enough to satisfy both debtors and creditors, but this creates an imbalance of supply and demand for bonds, which leads to the Federal Reserve having to print money and redistribute wealth. He also notes that the biggest risk to the economy is a supply-demand risk and predicts that we will see a lot of bonds being sold, which will lead to the Federal Reserve printing more money.

Highlights

- Interest rates must be high enough to satisfy both debtors and creditors, but this creates an imbalance of supply and demand for bonds, leading to the Federal Reserve having to print money and redistribute wealth.

- The biggest risk to the economy is a supply-demand risk for bonds, which may lead to the Federal Reserve printing more money to meet demand.

- The amount of labor created and credit is important when considering inflation rates.

- Labor components are not a net positive in the current economic climate, and demographics are not favorable due to a lesser population and the need to draw down savings.

- The government has borrowed a lot of money, and the big losers of the debt cycles are central and commercial banks, which have lost a lot of money due to government bond holdings.

- The economy is heading towards a debt crisis due to rising interest rates and large amounts of debt.

Thomas Friedman and Ray Dalio Discuss the Changing World Order Jun 14, 2023

Thomas Friedman interviews Ray Dalio on his book “Principles of a Changing World Order”. Dalio identifies five factors that lead to the rise and fall of countries and economies, detailing the patterns with a 40-minute video. He warns about the US being at a low point in the current cycle and suggests a strong middle is needed for healthy change.

Highlights

- Central banks printing money and increasing debt creation are two of three big and unprecedented occurrences that are happening in our lifetimes.

- The changing world geopolitical situation is the third unprecedented occurrence happening in our lifetime.

- Droughts, floods and pandemics have a bigger effect on toppling civilizations than the aforementioned three.

- Technology as a result of man’s learning is the biggest force over a long period of time.

- Dalio charts the cycles and patterns of the rise and fall of empires for last 500 years.

- The cycle typically begins after a major conflict, leading to a period of peace and prosperity until the financial bubble bursts.

- The alarms are being heard, however, structural and financial issues persist and strong middle is needed to bring healthy change.

I am a student in this subject, so I won't pretend I fully understand all the implications of what Dalio is predicting here. But the patterns he describes — especially the debt cycle dynamics — feel very real to me as someone who moved to the US recently and is watching this economy up close.

Have you been following Dalio's work? Do you find his framework useful for making sense of what's happening? I'd love to hear your thoughts :)

Cheers,

Chandler

More from this series

- The Changing World Order: Ray Dalio's insights — the main hub with all updates

- Ray Dalio's 2024 Great Powers Index — the latest analysis

- Assessing Ray Dalio's latest warnings on geopolitical tensions (Oct 2023)