Recently, my family and I embarked on our first trip to Yosemite National Park. The breathtaking scenery left us in awe, and I felt compelled

Read more

A personal blog about expatriates in the US, AI, Leadership, Geopolitics.

Recently, my family and I embarked on our first trip to Yosemite National Park. The breathtaking scenery left us in awe, and I felt compelled

Read moreHi there, As per my previous post, I recently relocated to the US in late 2021. And I want to journal my experience through time.

Read more

Are you thinking of making the big move from Asia to the US? It can be a complicated task, but you can make it a

Read more

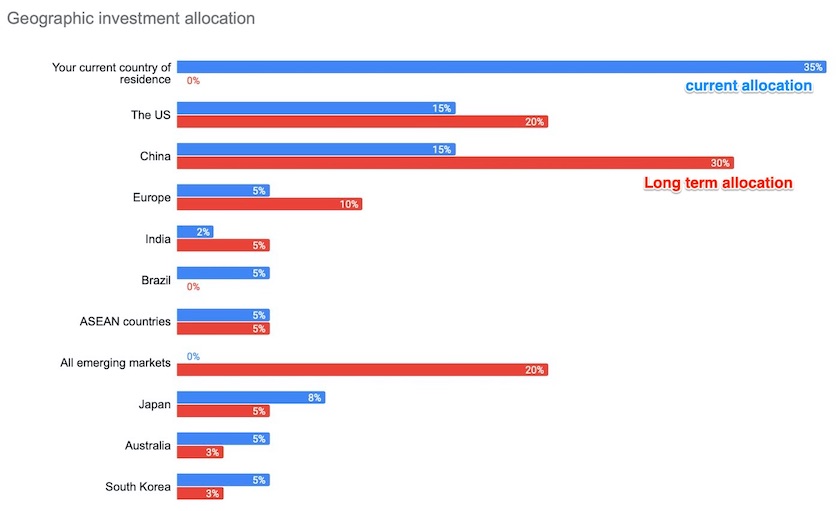

I am a big fan of Ray Dalio’s sharing/teaching. I have been reading his books, articles on LinkedIn, and watching his Youtube videos. Recently, Ray has been sharing a series about the Changing World Order and lessons learned from the big cycles over the past 500 years. He also appeared on Bloomberg to share his thoughts about the Economy, Pandemic, China’s Rise. This interview is similar to a discussion Ray had with Jim Haskel on Bridgewater Associates’ Youtube channel about “Managing Money in a Zero Interest Rate Environment”.

Ray’s sharing has many implications for the world economy, policymakers, investors, etc. At a personal finance level, his main recommendation is diversification. This post is about how I interpret his recommendations and apply them to personal finance.

The context behind this question is that as our world is changing faster and faster due to new technologies (genetics, artificial intelligence, robotics, nanotechnology and

Read more