Are you an expat in the United States? If so, you need to know about health saving account (HSA). Here’s what you need to know about health saving accounts and why they are a must-have for expats in the US.

(Please note that this is the information I have learned as an expat. And they are subject to change after this post is written so please do your OWN research to make informed decisions).

1. What is a health saving account?

A health savings account (HSA) is a special type of savings account that helps you save money to pay for medical expenses. To be eligible for an HSA, you must have a high-deductible health plan. This means that your health insurance plan has a higher-than-average deductible. For 2023, according to the IRS, “For calendar year 2023, a “high deductible health plan” is defined under § 223(c)(2)(A) as a health plan with an annual deductible that is not less than $1,500 for self-only coverage or $3,000 for family coverage, and for which the annual out-of-pocket expenses (deductibles, co-payments, and other amounts, but not premiums) do not exceed $7,500 for self-only coverage or $15,000 for family coverage.“

If you have a high deductible health plan, you can use an HSA to pay for your deductible, copayments, and coinsurance.

2. How does a health savings account work?

When you open an HSA, you contribute money to the account. The money in your HSA can be used to pay for qualifying medical expenses at any time. Your contributions are tax-deductible, and the money in your HSA grows tax-free. You can use your HSA to pay for health care expenses until you reach retirement age.

3. Who is eligible for a health savings account?

To be eligible for an HSA, you must be enrolled in a high-deductible health plan (as defined above). So expats are eligible to use HSA as long as your plan is a high-deductible plan.

If you don’t know if your employer is offering a High-deductible health plan to you, check with your HR/Benefits team. In addition, I wrote additional details about the Pros and Cons of Choosing a High Deductible Health Plan (HDHP).

You cannot be enrolled in a health plan that is not a high-deductible health plan, such as a health maintenance organization (HMO) or a preferred provider organization (PPO). You also cannot be enrolled in Medicare. In addition, you cannot have another health insurance plan that is not a high-deductible health plan. For example, if you have a health plan through your job and a health insurance policy that is not a high-deductible health plan, you are not eligible for an HSA.

4. How much can I contribute to a health savings account?

For 2023, the maximum contribution limit for an HSA is $3,850 for an individual with self-only coverage or $7,750 for an individual with family coverage. If you are age 55 or older, you can contribute an additional $1,000 to your HSA.

For 2024, according to IRS website, “if you have self-only HDHP coverage, you can contribute up to $4,150. If you have family HDHP coverage, you can contribute up to $8,300.“

5. How do I use a health savings account?

It is likely that after you sign up and start contributing to your HSA account, the bank will send you a debit card. This debit card is linked to your HSA account. So when you use this debit card for qualified expenses, the money will be deducted from your HSA account.

To use your HSA, you simply need to present your health insurance card and HSA debit card at the time of service. The health care provider will then bill your health insurance company first and your HSA second. You will not have to pay anything out-of-pocket if you have enough money in your HSA to cover the entire bill. If you do not have enough money in your HSA to cover the entire bill, you will only be responsible for paying the amount that is not covered by your health insurance or HSA.

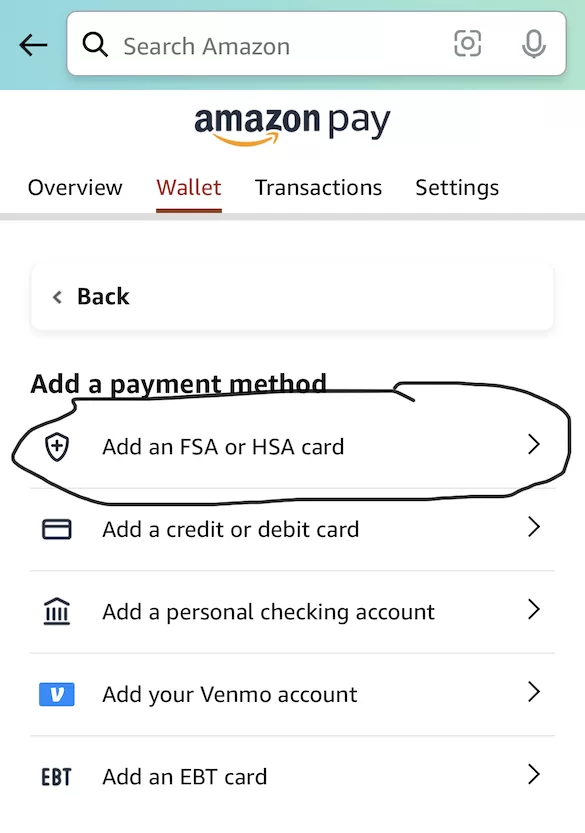

For example, you can enter the debit card details into Amazon under “Add an FSA or HSA card.” Then, when you shop on Amazon, if the item is eligible under FSA/HSA, Amazon will show that notification. And you can select the corresponding debit card to pay.

6. What are the benefits of a health savings account?

There are many benefits of having an HSA, including:

- Tax savings: Your contributions to your HSA are tax-deductible, and the money in your HSA grows tax-free. This means no capital gain tax for your HSA investment gain (if any).

- For example, if your top marginal tax rate is 25% and you contribute $5000 to HSA, you save $1,250 on tax. This is huge 🙂

- Flexibility: You can use your HSA to pay for a wide range of qualifying medical expenses at any time.

- Savings for retirement: You can use your HSA to pay for health care costs not covered by Medicare when you retire.

- “Contributions to your HSA made by your employer (including contributions made through a cafeteria plan) may be excluded from your gross income.” – IRS website

- “Distributions may be tax-free if you pay qualified medical expenses. See Qualified medical expenses later.” – IRS website

7. Are there any drawbacks to having a health savings account?

There are a few potential drawbacks to having an HSA, including:

– High deductibles: You must have a high-deductible health plan to be eligible for an HSA. This means that you may have to pay more out-of-pocket costs before your health insurance plan kicks in.

– Contribution limits: There are limits on how much you can contribute to your HSA each year. If you have high healthcare costs, you may be unable to cover all your expenses with your HSA. The limit for 2023 is mentioned above. And it is subject to change year after year.

Despite these potential drawbacks, HSAs can be a great way to save for health care costs. If you are eligible for an HSA, be sure to take advantage of the tax savings and flexibility that it offers.

8. How do I open a health savings account?

If you are eligible for an HSA, you can open one through a health insurance company, a bank, or a partner your employer is working with. There are many different HSA providers, so be sure to compare their fees and features before you decide on one. Once you have opened your HSA, you will need to fund it with contributions from your paycheck or your own savings. You can start contributing to your HSA as soon as you enroll in a high-deductible health plan.

9. What happens to my health savings account if I change jobs?

If you change jobs, you can take your HSA with you. Your HSA is portable, meaning it is not tied to your job. You can keep your HSA even if you leave your job or switch to a health plan that is not a high-deductible health plan.

10. Can I use my health savings account to pay for health insurance premiums?

Yes, you can use your HSA to pay for health insurance premiums and other qualifying medical expenses. However, you can only use your HSA to pay for health insurance premiums if you are unemployed, between jobs, or enrolled in a health insurance plan through the Marketplace.

11. Other Health savings account (HSA) commonly asked questions

Can I open a HSA on my own?

Yes, you can after you enroll in an HSA-eligible HDHP.

Can you withdraw money from HSA?

“Yes. You can withdraw funds from your HSA anytime. But keep in mind that if you use HSA funds for any reason other than to pay for a qualified medical expense, those funds will be taxed as ordinary income, and the IRS will impose a 20% penalty.

After you reach age 65 or if you become disabled, you can withdraw HSA funds without penalty, but the amounts withdrawn will be taxable as ordinary income if not used for qualified medical expenses.” Answer from Michigan state website.

What is the last-month rule for HSA?

Answer from the IRS: Under the last-month rule, you are considered to be an eligible individual for the entire year if you are an eligible individual on the first day of the last month of your tax year (December 1 for most taxpayers)

How much do I need to open an HSA account?

There is no minimum to open an HSA account as long as you are eligible. There should not be any monthly fees too.

How does HSA affect my paycheck?

Your contribution to HSA through your salary will be deducted from your paycheck on a pre-tax basis. So that means your take-home amount will reduce accordingly.

Can I buy groceries with my HSA card?

No. You can not use your HSA card to buy normal groceries as the HSA fund is for qualified medical expenses only.

Can I use my HSA card at a gas station?

This is a good question. I am not exactly sure myself. But from the HSA store website, it seems that you can. “Fuel is eligible for transportation to and from medical care, up to the allowed mileage rate. Fuel, gasoline for medical care reimbursement is eligible with a flexible spending account (FSA), health savings account (HSA) or a health reimbursement arrangement (HRA). Fuel, gasoline for medical care reimbursement is not eligible with a limited-purpose flexible spending account (LPFSA) or a dependent care flexible spending account (DCFSA).”

What can I buy with HSA dollars?

You can use various online tools like this one from Optum bank for qualified expenses.

What happens if you don’t spend your HSA?

You will not lose the money in your HSA because it doesn’t have a “use it or lose it” rule. If you don’t spend the money in your HSA, it will roll over year after year.

How much should I put in my HSA per month?

Think about the maximum contribution you can make per year and how much you can save for future healthcare expenses. Also, consider the amount your employer may contribute to your HSA account (if they offer this benefit).

Can I have FSA and HSA in 2023?

Generally, you can’t contribute to a health FSA and a HSA at the same time. However, if your employer allows, you contribute to a limited-purpose FSA (LPFSA) and HSA.

Who are the largest HSA providers in the US?

According to Morningstar, the four largest HSA providers in 2022 are: HealthEquity, Optum, Fidelity and HSA Bank.

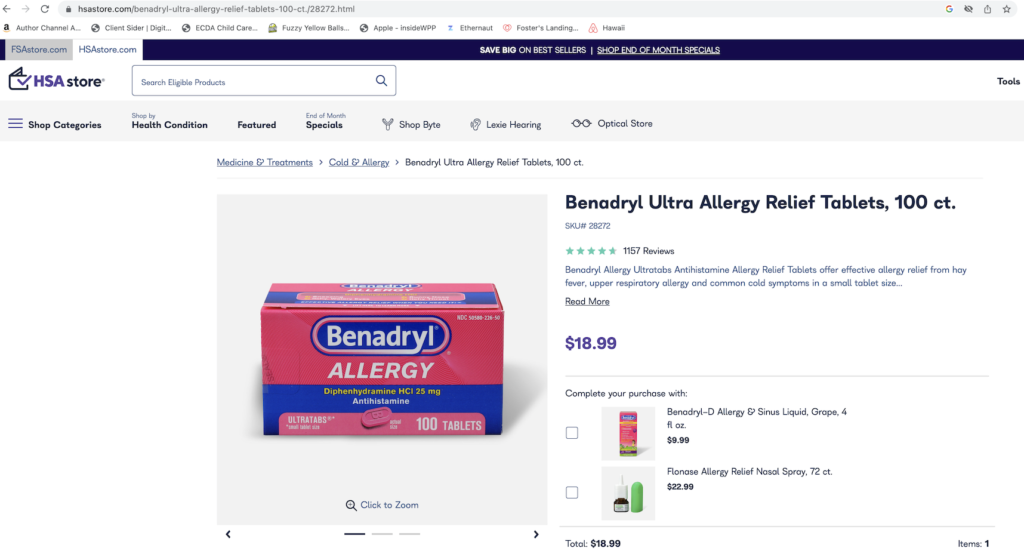

Should I only buy medication from HSA Store?

No. Check different providers to find the best deals. HSA Store may not have the best price.

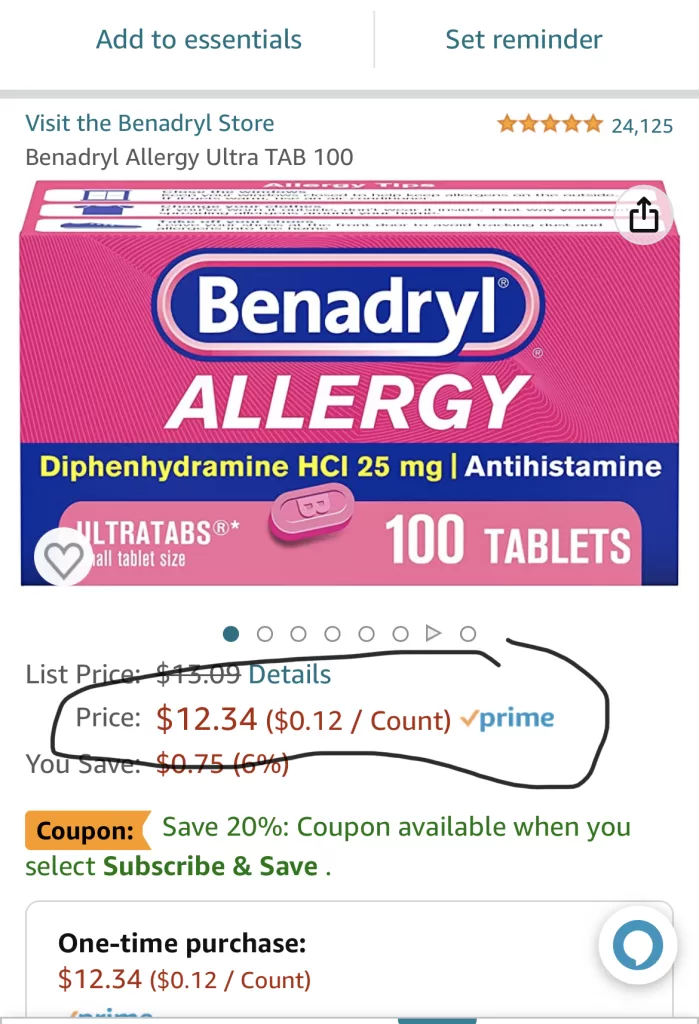

For example, as of Feb 2023, Benadryl is 50% more expensive on HSA Store vs on Amazon. And you can use an HSA debit card to pay on Amazon too. (The main ingredient is Diphenhydramine HCI 25 mg).

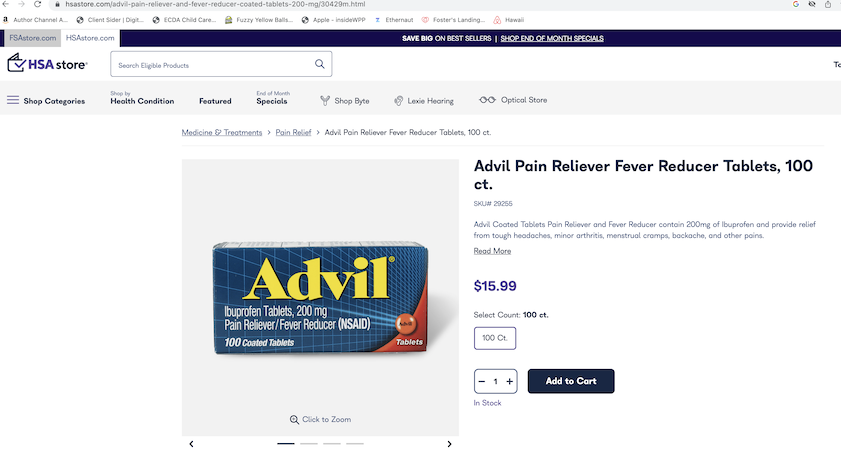

The same situation happens with Advil where HSA Store price is 50% higher than on Amazon.

Share this with a friend

If you enjoyed this article and found it valuable, I’d greatly appreciate it if you could share it with your friends or anyone else who might be interested in this topic. Simply send them the link to this post, or share it on your favorite social media platforms. Your support helps me reach more readers and continue providing valuable content.

Conclusion

In conclusion, health savings accounts (HSAs) can be a valuable tool for expats in the United States who have high-deductible health plans. HSAs offer tax savings, flexibility, and the ability to save for healthcare costs in retirement. While there are some potential drawbacks to consider, such as high deductibles and contribution limits, the benefits of an HSA generally outweigh the risks. Additionally, it’s important to note that the rules and regulations surrounding HSAs are subject to change, so staying informed and seeking professional advice when necessary can help ensure you make the most of your HSA.

Last but not least, I recently created a group on Facebook called Asian Expats in the US so that we can share/discuss more tips directly. Feel free to join.

That’s all from me. Let me know what you think via the comments below.

Chandler

P.S: George Kamel just made a video about HSA that is informative and entertaining. You can check it out below.

[jetpack_subscription_form]