Panorama publicitário da Austrália: 8 fatos e tendências importantes

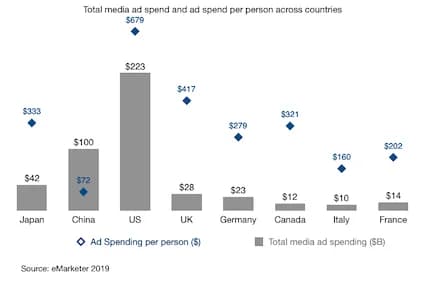

Os australianos veem mais anúncios por pessoa do que a maioria dos países do G7, mas lideram o mundo no bloqueio deles — uma tensão crítica que molda o futuro do marketing digital.

99 posts nesta categoria

Os australianos veem mais anúncios por pessoa do que a maioria dos países do G7, mas lideram o mundo no bloqueio deles — uma tensão crítica que molda o futuro do marketing digital.

Os mais de 270 milhões de habitantes da Indonésia fazem do país o 5º maior mercado de internet do mundo, com usuários mobile-first impulsionando um crescimento explosivo em e-commerce e redes sociais.

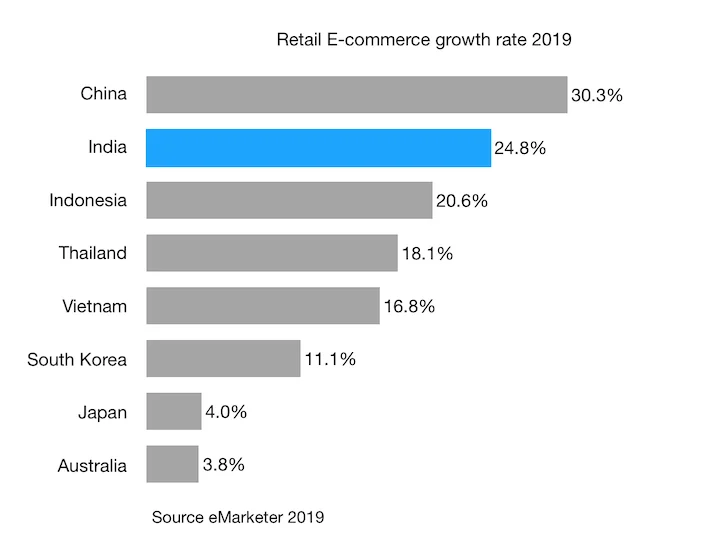

O mercado de varejo da Índia ocupa o terceiro lugar na APAC com a maior taxa de crescimento, mas o e-commerce ainda é surpreendentemente pequeno — enquanto a penetração do m-commerce lidera o mundo.

O mercado de pagamentos digitais da Índia está prestes a explodir, passando de $200B para $1 trilhão até 2023, impulsionado pela adoção de pagamentos mobile que cresce mais rápido do que em qualquer outro lugar.

Apesar de 1,3 bilhão de pessoas, o mercado publicitário da Índia é de apenas $10B — com gasto per capita entre os mais baixos do mundo, revelando um paradoxo de escala versus monetização.

Apesar de ser o 3º maior mercado de varejo do mundo, a penetração do e-commerce no Japão fica muito atrás da China e de outros países do G7 — mesmo com a adoção de compradores digitais atingindo saturação.

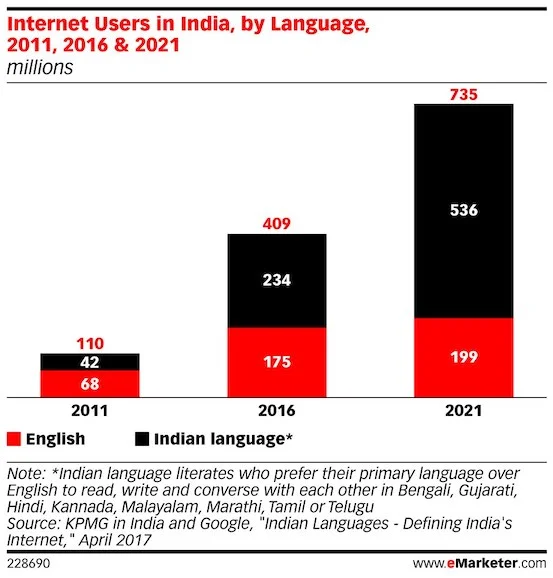

O mercado de internet da Índia está preparado para um crescimento explosivo: mais de 460 milhões de usuários representam baixa penetração, 90% acessam via mobile e falantes de idiomas não-ingleses superam os usuários em inglês — criando oportunidades imensas em conteúdo vernacular, vídeo e pagamentos mobile.

O mercado publicitário do Japão revela uma defasagem surpreendente: o gasto em mobile fica muito atrás da China e da Coreia do Sul, enquanto o crescimento digital avança a mais de 10% ao ano.

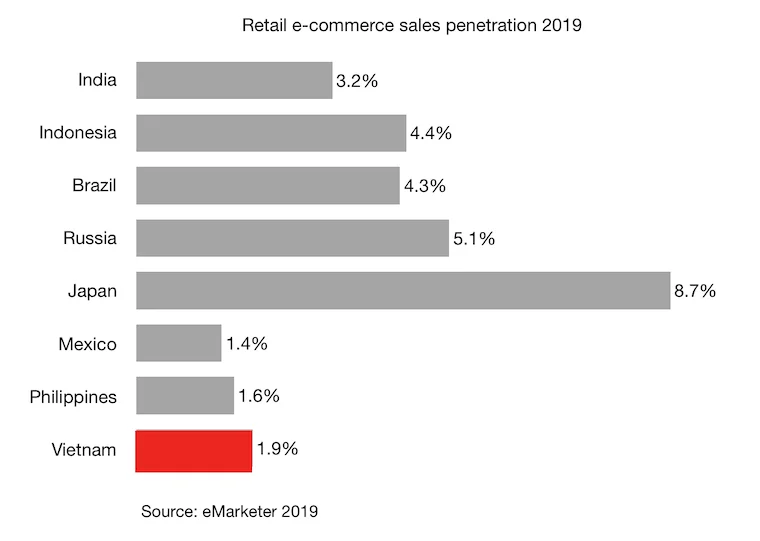

O mercado de e-commerce do Vietnã mostra um potencial paradoxal: menos de 2% de penetração apesar do forte crescimento econômico, com as vendas digitais de viagens superando o varejo online.

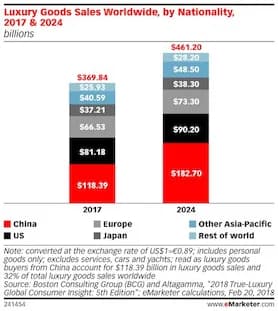

A China domina as vendas globais de luxo com consumidores afluentes mais jovens e digitalmente conectados, que pesquisam online mas compram presencialmente — o que todo profissional de marketing precisa saber.

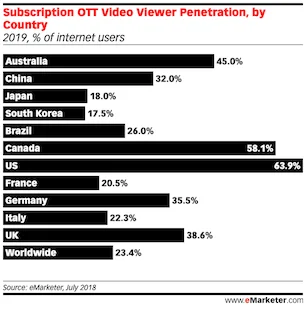

O mercado de SVOD da Coreia do Sul enfrenta desafios únicos com apenas 18% de penetração — prejudicado pela saturação de 100% em Pay TV — obrigando as plataformas a competir intensamente por conteúdo local.

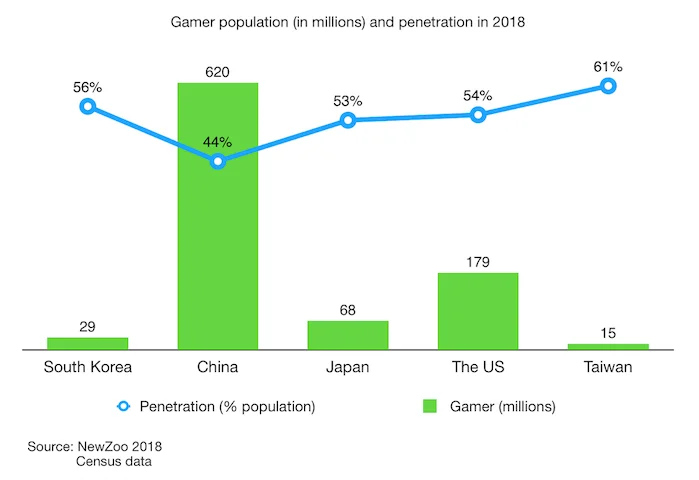

O mercado de jogos mobile da Coreia do Sul ocupa o 4º lugar no mundo, com uma receita por usuário pagante notavelmente alta e custos de aquisição menores que nos EUA — tornando-o um alvo prioritário para desenvolvedores de games.